Knowledge reveals that “paper” Bitcoin has seen vital features just lately, whereas the spot worth of cryptocurrencies has fallen considerably.

Paper Bitcoin has been rising whereas spot Bitcoin stays unchanged

in a brand new Wire On X, analyst Willy Woo talked concerning the state of the Bitcoin market. BTC has been trending bearishly just lately, with the German authorities sell-off and Mt. Gox distribution being the 2 principal sources of FUD for traders.

Woo famous that Germany offered roughly 10,000 Bitcoins, of which 39,800 stay in authorities custody.

The information for the holdings confiscated by the German authorities | Supply: @woonomic on X

Mt. Gox has not distributed that a lot BTC but, returning solely 2,700 BTC to its house owners. The bankrupt change nonetheless has 139,000 BTC accessible for distribution, however the detrimental influence of those holdings is dependent upon whether or not the holders receiving the tokens are keen to promote.

The pattern within the Mt. Gox steadiness over time | Supply: @woonomic on X

These two entities aren’t placing that a lot precise promoting strain in the marketplace but. So, what’s the actual offender behind the Bitcoin crash? In line with analysts, this seems to be Paper Bitcoin.

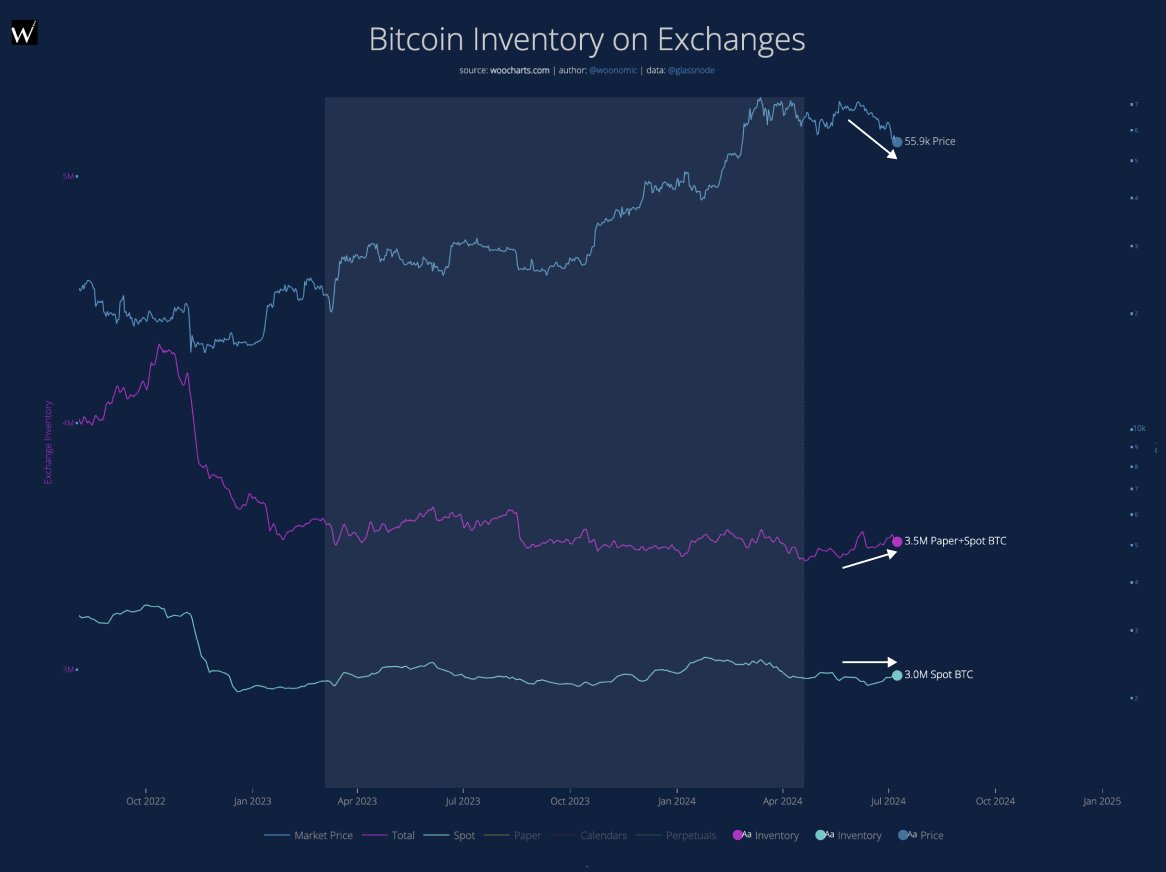

Paper Bitcoin is Derivatives Related to cryptocurrencies that don’t require any precise possession of BTC tokens. The chart beneath reveals how Bitcoin has carried out through the asset’s newest plunge.

Appears just like the paper plus spot BTC steadiness has been on the rise on exchanges | Supply: @woonomic on X

Within the determine, the purple line displays the present whole stock of banknotes and spot BTC on varied centralized exchanges within the trade. The stock has been trending upward just lately.

Nevertheless, this enhance is also as a consequence of spot deposits fairly than the minting of paper Bitcoins. Nevertheless, as proven by the blue curve, spot BTC has been exhibiting a flat trajectory whereas general inventories have elevated. This is able to verify that paper Bitcoin is certainly driving this development.

A complete of 140,000 extra banknote BTC have been just lately printed. “Now examine that to the ten,000 Bitcoins offered in Germany and you may see what brought about the sell-off,” Woo stated. Subsequently, if cryptocurrencies should obtain a point of restoration, derivatives might rise considerably.

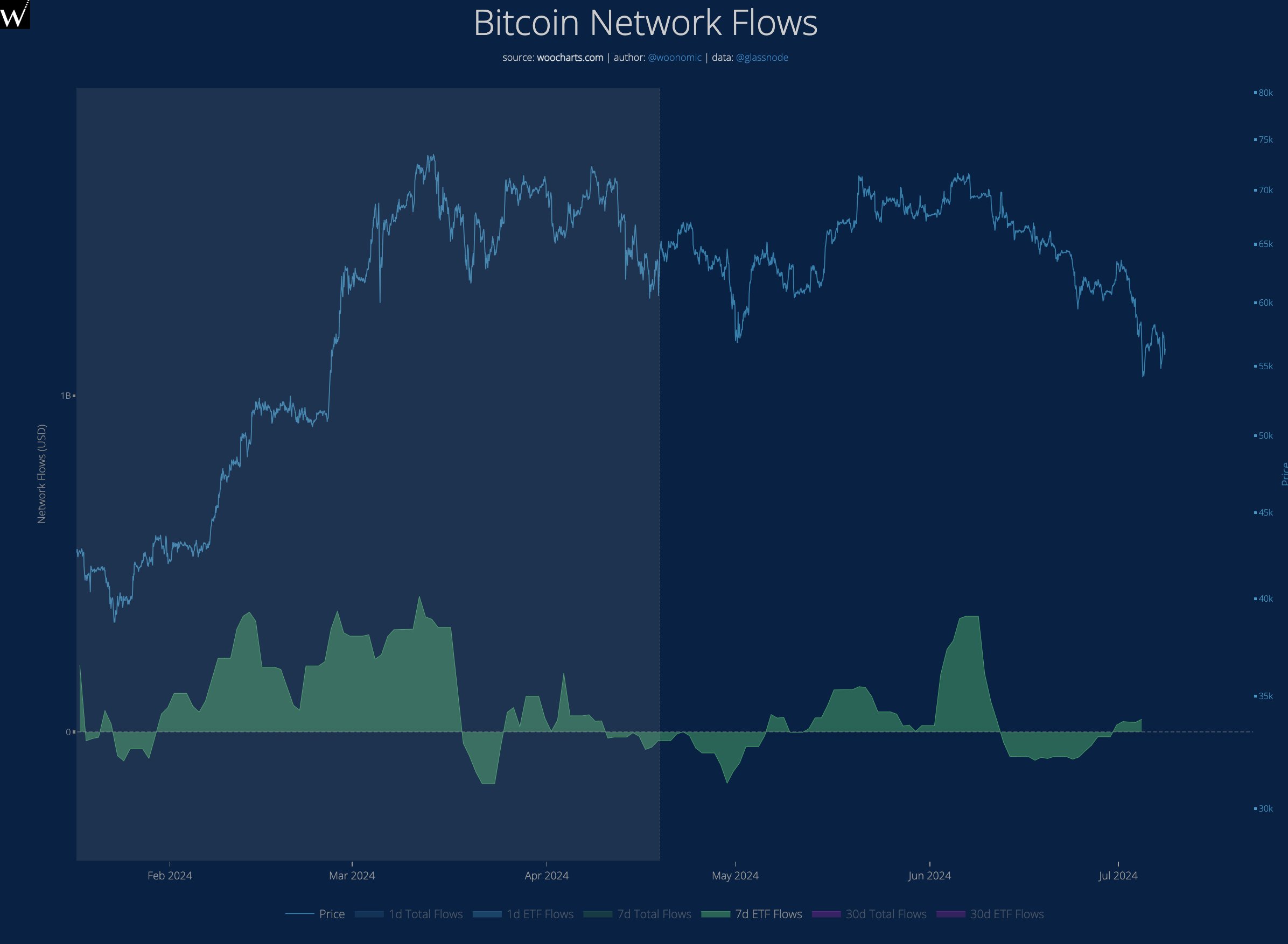

Whereas the remaining sell-off from Mt. Gox and the German authorities is making a bearish pattern, the coin might also be forming a bullish pattern. As analysts defined, Spot Exchange Traded Funds (ETFs) Already beginning to present early indicators of accumulation.

The pattern within the 7-day netflows of the BTC spot ETFs | Supply: @woonomic on X

bitcoin worth

The previous month has been a troublesome time for Bitcoin holders, because the asset’s worth fell by greater than 17% to $57,200.

The value of the coin has been using on bearish momentum just lately | Supply: BTCUSD on TradingView

Featured pictures from Dall-E, woocharts.com, charts from TradingView.com