After October 7, 2023 Hamas attackIsraeli navy operations in Gaza and their humanitarian consequences The problem of commerce sanctions towards Israel has sparked public debate. As of July 2024, Israel’s offensive has killed greater than 37,000 Palestinians. That number could rise to more than 186,000 When contemplating oblique deaths as a consequence of elements equivalent to injury to well being care infrastructure or meals and water shortages. Seventy % of the homes in Gaza had been destroyed and 80 % of the inhabitants was displaced. In response, Turkey suspended commerce, whereas different international locations, together with Belgium, Canada, Italy, Japan, the Netherlands and Spain, has decided to stop the arms trade. In Europe, the governments of Belgium, Eire and Spain Publicly advocate for the imposition of trade sanctions. This situation was additionally raised EU Foreign Affairs Council.

Financial sanctions have develop into an vital device in modern overseas coverage. As of 2023, the United Nations administers 14 ongoing sanctions, whereas the US has imposed greater than 25 sanctions for the reason that early 2000s. Study its effectiveness present that when financial sanctions impose giant financial prices on the goal economic system, are multilateral, are led by worldwide establishments, are aimed toward modest coverage modifications reasonably than bold objectives, goal allies reasonably than adversaries, and goal democratic regimes, Financial sanctions are typically more practical.

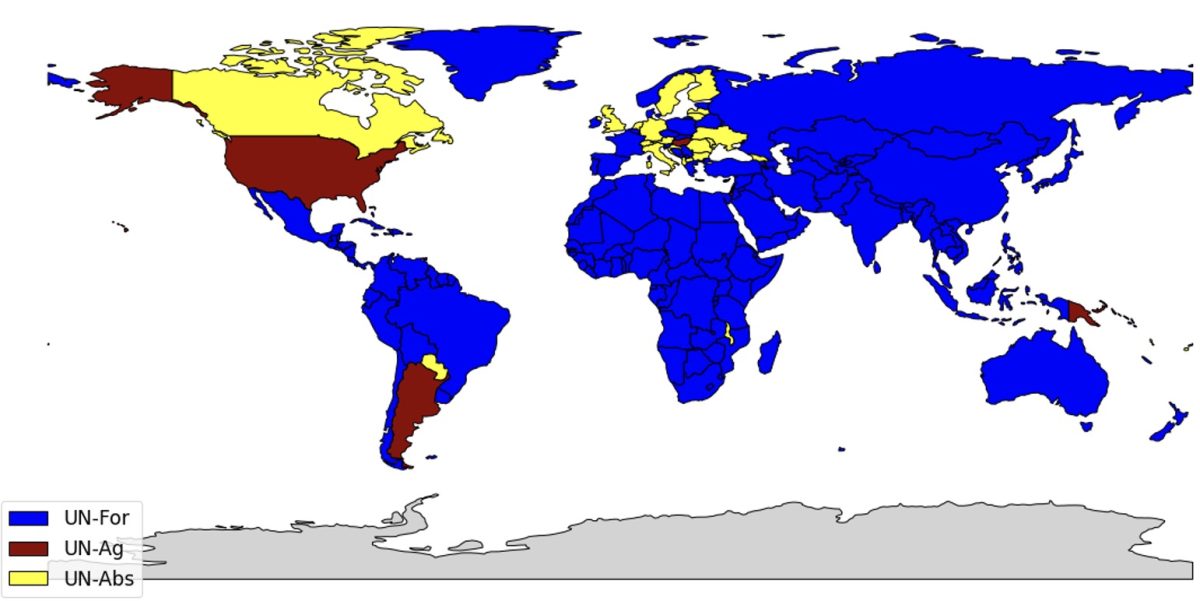

On this evaluation, I exploit a multi-country, multi-sector commerce mannequin to look at the impression of tariff sanctions on Israel. This mannequin is predicated on De Souza et al. (2024), Caliendo and Paro (2015) and Bones(2014). Companies in every nation competitively produce tradable items in numerous sectors, each for remaining consumption and as elements of manufacturing together with labor and intermediate inputs. Commerce is affected by iceberg prices in addition to import and export tariffs set by governments. I exploit calibration mannequin OECD country input-output table, an information set describing the interdependencies between 45 financial sectors and 76 international locations. I divided international locations into 4 teams primarily based on how they voted on the resolutions (A/ES-10/L.30/Rev.1) Assist Palestine’s accession to the United Nations: Israel, international locations that voted towards the decision (known as “UN-Ag”, together with 9 international locations together with the US, Argentina, and Hungary), and international locations that voted in favor of the decision (known as “UN-For” , 143) China, France, Japan and different international locations) and abstaining international locations (known as “UN-Abs”, 25 international locations together with the UK, Germany, Italy, Canada, and so on.). Determine 1 reveals a map of nations primarily based on completely different voting profiles.

I believe the sanctioning international locations are international locations within the “UN-For” group. I admit that this assumption is basically arbitrary. The query of which international locations usually tend to impose sanctions is past the scope of this evaluation. The goal right here is to evaluate the impression of such sanctions. I examine this group to different hypothetical coalitions of sanctioning international locations: the EU, BRICS (Brazil, Russia, India, China, South Africa) and the US. Lastly, whereas I focus right here on the financial penalties of import and export tariffs, financial sanctions will also be imposed by quite a lot of different means, together with asset freezes, monetary market sanctions, or entry restrictions on key authorities officers and enterprise executives.

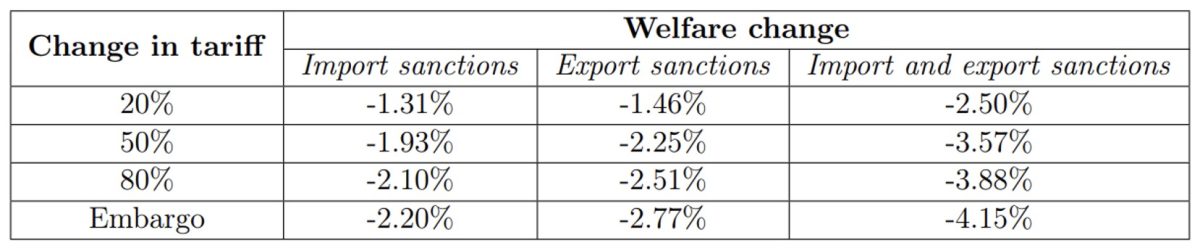

The outcomes proven in Desk 1 point out that the impression of export tariffs is barely larger than that of import tariffs. If import tariffs change by 20%, Israel’s gross nationwide earnings (GNI) will lower by 1.31%, or as much as 2.20% if imports are banned. If the export tariff modifications by 20%, it should fall by 1.46%, and if there’s an export ban, it should fall by 2.77%. When the 2 measures (import and export tariffs) are mixed, the discount ranges from 2.50% (20% tariff) to 4.15% (commerce embargo). Lastly, in all instances, the impression of sanctions on different international locations (each sanctioned and non-sanctioned) is negligible, round -0.02%. This implies there aren’t any financial trade-offs in tariff ranges: it’s a political selection.

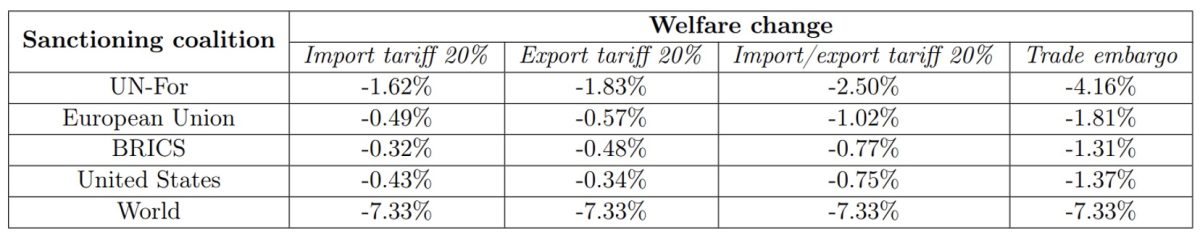

Desk 2 compares the outcomes for various coalitions of sanctioning international locations. A 20% improve in EU import and export tariffs will cut back Israel’s GNI by 1.02%. The BRICS international locations additionally elevated, with a lower of 0.77%, which is roughly the identical as that of the US (0.75%). As compared, the impression of the EU commerce embargo is -1.81%, the impression of the BRICS commerce embargo is -1.31%, and the impression of the US commerce embargo is -1.37%. Within the excessive case, if all international locations on this planet had been put right into a commerce embargo, the impression could be -7.33%. This reveals that the bigger the coalition imposing sanctions, the extra important the financial impression.

These values are within the following ranges Neuenkirch and Neumeyer (2015), they estimate that the impression of “harsh” UN sanctions, equivalent to a complete embargo imposed by UN member states on a goal nation, would have an effect on GDP progress of about -5% to -6%. They’re additionally per the prediction of the Armington mannequin that the welfare advantages from commerce must be at the very least equal to 1 − λ−1/e, the place λ is one minus import penetration and ε is commerce elasticity. Israel’s import penetration fee is 17%, so λ=0.83 and the commerce elasticity is about -5, which signifies that the welfare loss attributable to the embargo is at the very least 3.66%.

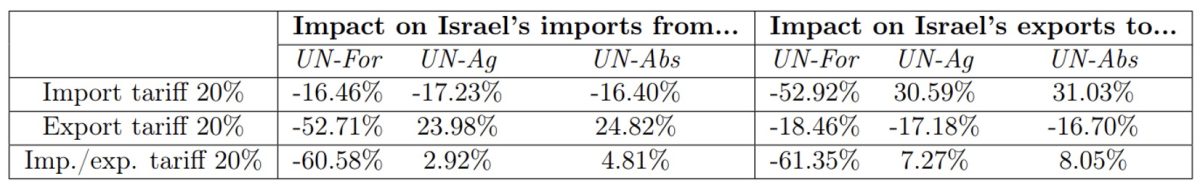

Desk 3 reveals the impression of sanctions on commerce between Israel and different international locations. United Nations – For imposing a 20% import (or export) tariff would scale back Israel’s exports (or imports) to those international locations by 52.92% (or 52.71%). This shall be partially offset by elevated Israeli exports (or imports) to non-sanctioned international locations: 30.59% extra exports to UN-Ag and 31.03% extra exports to UN-Abs (23.98% extra exports from UN-Ag and 23.98% extra from UN-Abs, respectively). Ab export elevated by 24.82%) – Abs).

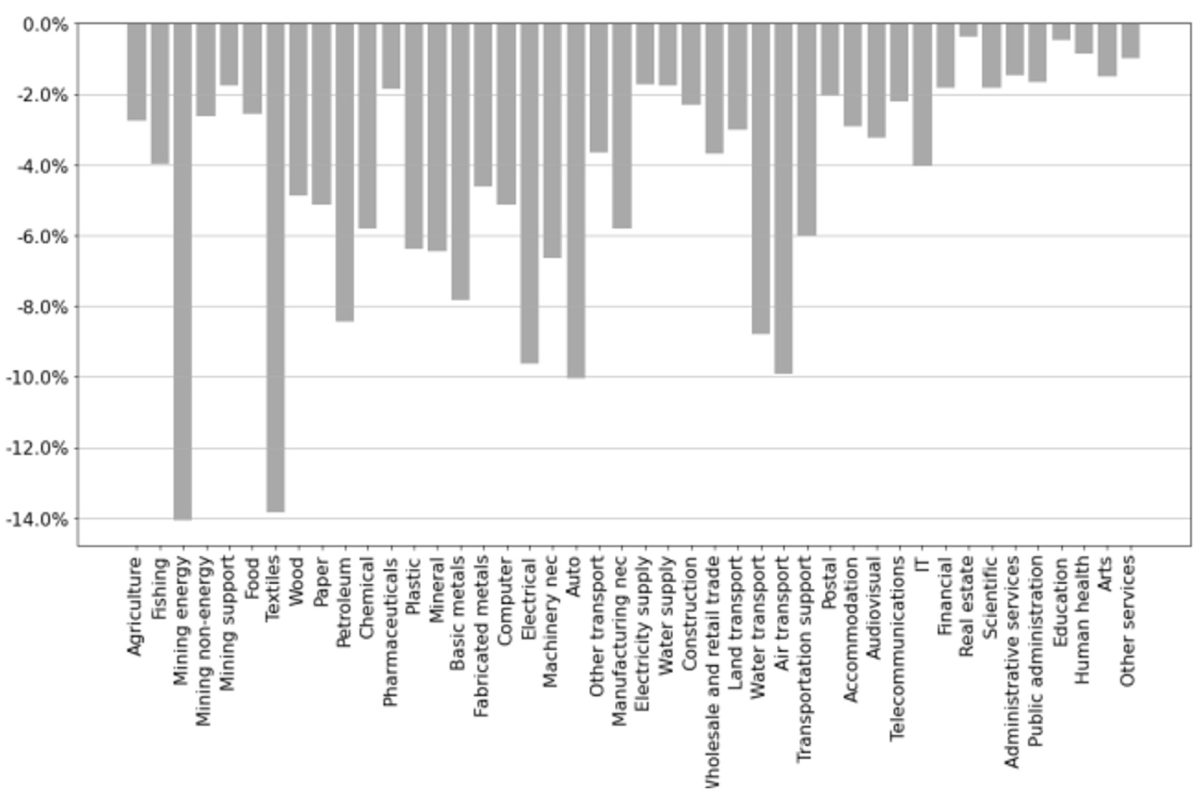

I now take a look at the breakdown of the impression of commerce sanctions by sector. I assume that the sanctioning international locations will improve import and export tariffs by 20%, and Israel won’t impose any counter-sanctions. I additionally assume that meals and medication won’t be sanctioned.

Determine 2 reveals modifications within the buying energy of wages (PPW) throughout completely different sectors. It reveals how a lot the amount of products or providers that may be bought per unit of wages has modified in every sector on account of sanctions. The industries with probably the most important declines in PPW had been fossil fuels (-14.07%) and textiles (-13.83%). Refined petroleum (-8.43%) was additionally considerably impacted because of the impression on fossil fuels. Different industries with sharp declines embody vehicles (-10.06%), air transport (-9.92%) and electrical gear (-9.63%). The impression on important items equivalent to meals (-2.58%), medicines (-1.85%) and electrical energy (-1.73%) remained reasonable.

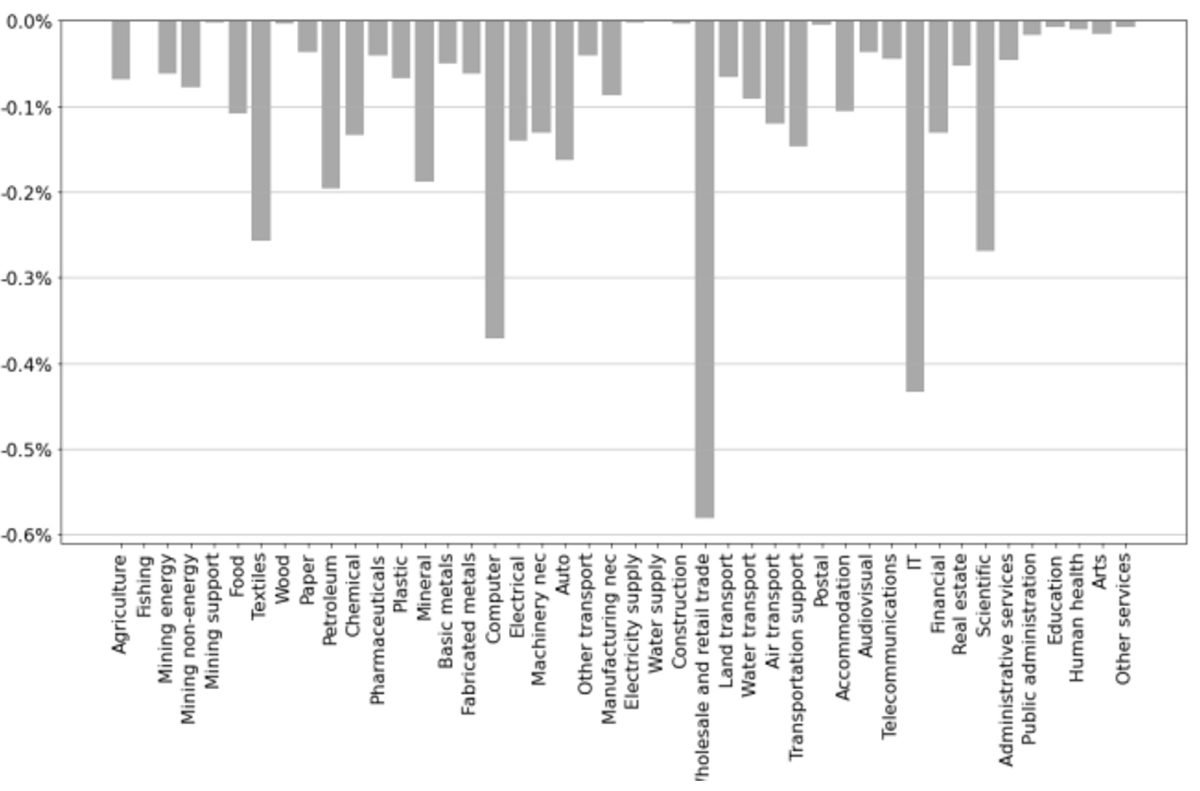

Lastly, I study which sectors are most successfully focused by sector-specific sanctions. Determine 3 reveals the modifications in Israel’s gross nationwide earnings on account of the commerce embargo in numerous sectors. Sectors the place focused sanctions are best embody wholesale and retail commerce, info know-how (IT), laptop and scientific providers. The final three sectors emphasize Israel’s dependence on its high-tech economic system. As of 2022, the high-tech trade will account for 18.1% of Israel’s GDP, a rise of 4 share factors from 2012, turning into the main sector of the nation’s economic system. Excessive know-how additionally accounts for 48.3% of Israel’s exports, a determine that has greater than doubled up to now decade.

The outcomes of this research point out that tariff sanctions might have a big impression on Israel’s gross nationwide earnings. Sanctions have been discovered to be more practical after they contain numerous sanctioning international locations and goal high-tech services and products.

tables and figures

Determine 1: Map primarily based on international locations’ votes on the decision admitting Palestine to United Nations membership (A/ES-10/L.30/Rev.1).

Determine 2: Adjustments in wage buying energy by sector.

Determine 3: Impression of sector-specific commerce embargoes on gross nationwide earnings, by sector.

Desk 1: Adjustments in Israel’s gross nationwide earnings on account of numerous tariff modifications.

Observe: Import sanctions are equal to the sanctions alliance elevating import tariffs. Export sanctions correspond to will increase in export tariffs by the Sanctioning Alliance.

Desk 2: Adjustments in Israel’s gross nationwide earnings by sanctions coalition.

Desk 3: Impression of tariff sanctions on Israel’s imports and exports.

Additional studying on digital worldwide relations