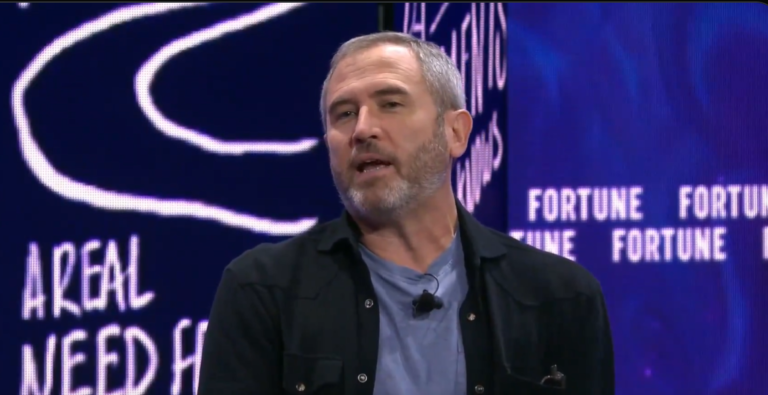

in a interview Ripple CEO Brad Garlinghouse joined Fortune’s Andrew Nusca to stipulate the corporate’s strategic roadmap, their cautious strategy to an preliminary public providing (IPO), and Ripple’s aggressive benefits over the normal SWIFT community.

Ripple will not be at the moment contemplating an IPO

Garlinghouse was outspoken about Ripple’s choice to delay its IPO amid a difficult regulatory atmosphere. He mentioned: “We’ve got acknowledged publicly that we would not have any quick plans to attempt to go public. I imply why would you serve within the present SEC. No. I’m not highly regarded throughout the SEC.

The sentiment highlights the friction between Ripple and regulators, particularly after the court docket’s landmark ruling final July that decided XRP was not a safety. as an alternative of getting ready initial public offeringRipple has adopted a special technique that Garlinghouse disclosed within the interview.

“I’ve all the time considered an IPO as a step within the journey, not the top of the journey. What we have executed, which is definitely new information that we have not shared publicly, we have made a sequence of tender presents. buy back shares The Ripple CEO revealed, including, “Now we’re making one other tender provide, and upon completion we are going to purchase again $4 billion of inventory from shareholders.”

Ripple VS. quick

Garlinghouse additionally commented on the corporate’s aggressive place relative to SWIFT, the worldwide commonplace for monetary messaging and cross-border funds. He criticized the outdated nature of the present wire switch system, stating, “The SWIFT community, I believe everybody right here in some unspecified time in the future in your life has executed a SWIFT switch, a SWIFT-enabled transaction that you just name a wire switch. “He emphasised the historic background, “The etymology of the phrase “wire switch” is telegraph wire switch, proper, this isn’t a know-how that strikes with the Web.”

Garlinghouse advocates Ripple’s transformative strategy that would considerably scale back friction in transferring cash around the globe, just like advances in digital communications. “Are we going to compete with SWIFT? Sure, there are quite a lot of fee networks on the market, and once I take into consideration the core factor that Ripple is making an attempt to do, we’re making an attempt to make worth transfer the best way data strikes at the moment,” he defined. By analogy to the evolution of e mail protocols connecting siled platforms, he emphasised Ripple’s purpose to advertise related interoperability between completely different fee networks.

When will the XRP lawsuit finish?

Garlinghouse additionally talked in regards to the lengthy authorized battle with the SEC over the standing of XRP, which resulted in big authorized payments, however in the end favorable ruling For Ripple. “I all the time considered it as a forex, and we engaged in a three-and-a-half-year authorized battle that culminated final summer time. We gained on the core difficulty that XRP was not a safety in itself, “He mentioned. However the authorized prices of this victory are big. “However there have been $150 million in authorized charges incurred within the course of,” Garlinghouse revealed.

speaking about Final Remedies and Penalty AwardsGarlinghouse expressed optimism that the lawsuit will likely be resolved quickly. “There are some things that I’d name suspense, and the decide ought to rule instantly, , possibly a month much less, possibly two months. I do not know that, however I am trying ahead to a full decision.

At press time, XRP was buying and selling at $0.58336.

Featured picture from X, chart from TradingView.com