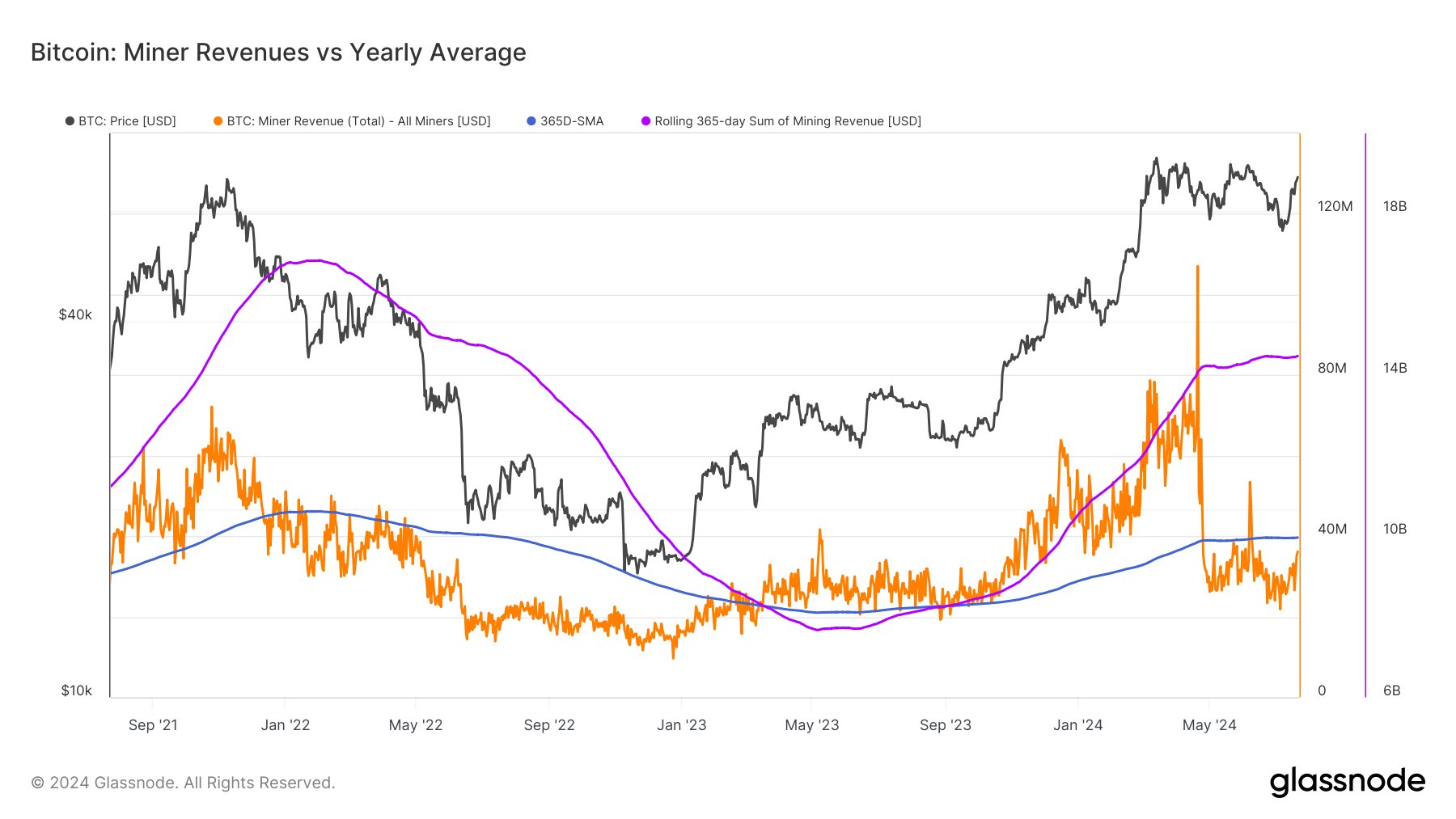

On-chain information reveals that Bitcoin mining income is near its annual common, suggesting that the capitulation of miners could also be coming to an finish.

Bitcoin miner income is now near the 365-day SMA

in a brand new postal On X, analyst James Van Straten mentioned the present scenario with BTC miners. There are a number of methods to measure miners’ situation, one of many well-liked strategies is Computing powerwhich is a measure of the whole computing energy linked to the Bitcoin community.

Nevertheless, right here analysts draw on day by day information Total revenue These chain validators. Miner earnings is split into two elements: block subsidies and transaction charges.

The primary refers back to the Bitcoin rewards miners obtain as compensation for fixing blocks on the community, whereas the latter refers to paying customers tied to particular person transactions. Traditionally, block subsidies have represented a a lot bigger portion of miner income than transaction charges.

The chart under reveals how whole Bitcoin miner income has modified over the previous few years.

The worth of the metric seems to have registered a pointy drop in latest months | Supply: @jvs_btc on X

As proven within the chart above, Bitcoin mining income started to climb together with the value enhance that started final October, reaching an all-time excessive (ATH) in April this 12 months.

There are two causes for this enhance. First, the worth and interval of block subsidies issued within the type of Bitcoin are normally fastened, so the one variable associated to them is the USD value of the asset. Due to this fact, it is sensible that earnings would enhance when costs rise.

On the identical time, the Web has change into busy because of the enhance in bull visitors. Transaction charges depend upon blockchain circumstances because the house accessible in blocks is restricted. As switch competitors intensifies, this house will naturally change into costlier.

The surge in ATH income was significantly pushed by: runes, a brand new on-chain know-how that permits customers to mint fungible tokens. Rune-related transactions are much like every other transactions on the community, so additionally they have an effect on the community economic system.

As might be seen from the chart, after this ATH, miner income dropped sharply and its worth fell under the 365-day easy shifting common (SMA).

The explanation behind that is The fourth halving. Whereas block rewards stay fastened most often, there are exceptions for halving occasions. These cyclical occasions happen each 4 years and completely minimize these rewards in half, drastically impacting miners’ earnings.

Since this drop, Bitcoin mining income has remained under the 365-day shifting common, placing strain on many miners and forcing a few of them to capitulate.

Nevertheless, with the latest restoration, miner income has risen to $35 million, not removed from the annual common of $40 million. “It was one other approach of signaling that the miners’ capitulation was coming to an finish,” van Straten defined.

Analysts stated that if the indicator can efficiently regain the 365-day shifting common, then Bitcoin could proceed to maneuver increased.

bitcoin value

Bitcoin’s restoration has stalled, with its value nonetheless hovering round $66,200.

Appears like the value of the asset has slumped to sideways motion over the previous few days | Supply: BTCUSD on TradingView

Featured photographs from Dall-E, Glassnode.com, charts from TradingView.com