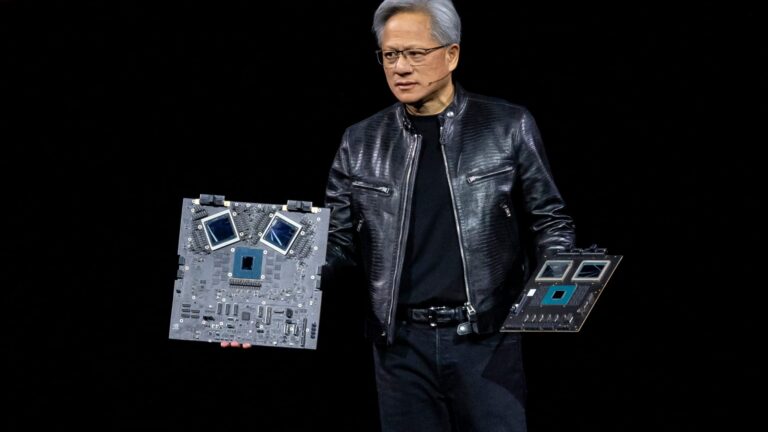

Nvidia co-founder and CEO Jensen Huang demonstrated the brand new Blackwell GPU chip on the Nvidia GPU Expertise Convention on March 18, 2024.

David Paul Morris/Bloomberg by way of Getty Photos

Earnings confirmed that not all chip corporations are benefiting from the bogus intelligence increase, underscoring the complexity of the semiconductor provide chain and the dominance of some corporations over others in numerous elements of the trade.

A variety of semiconductor corporations reported monetary outcomes for the June quarter, with some beating estimates and others disappointing, offering a glimpse into how the thrill about synthetic intelligence is affecting their earnings.

The present curiosity in synthetic intelligence primarily revolves round two key phrases – massive language fashions (LLM) and generative synthetic intelligence. The LL.M. requires huge quantities of computing sources and knowledge to coach, which underpins generative synthetic intelligence purposes comparable to chatbots Google and OpenAI.

The tech giants coaching LL.M.s usually are not reducing again. Yuan Mentioned about Wednesday is expected Capital expenditures will develop “considerably” by 2025 “to assist our synthetic intelligence analysis and product improvement efforts.” Microsoft clarify this week Capital spending within the June quarter rose practically 80% 12 months over 12 months to $19 billion.

As tech giants proceed so as to add computing sources, their spending has turn into A huge boost for Nvidia As a result of the corporate’s graphics processing models (GPUs) are used to coach these LL.M.

However Nvidia’s rivals AMD has introduced its personal chips to market, referred to as MI300X artificial intelligence chip, for synthetic intelligence functions, and are beginning to see returns. AMD stated on Tuesday it expects knowledge middle GPU income to exceed $4.5 billion in 2024, up from the $4 billion the corporate forecast in April. chip Company reports second-quarter profit, revenue This exceeded market expectations.

Chip manufacturing and tooling corporations additionally look like benefiting from the AI increase. British SemiconductorThe world’s largest semiconductor producer stated final month that its second-quarter web revenue rose greater than 36% yearly. Financial results beat market expectations.

on the similar time ASMLThe corporate makes the specialised instruments wanted to make the world’s most superior wafers, the corporate stated final month Second-quarter net bookings jump 24% The year-on-year progress highlights the wants of semiconductor producers comparable to TSMC. Samsung statedSecond quarter operating profit increased by 1,458.2% year-on-year.

However not all semiconductor corporations have been boosted by the expansion in AI investments as a result of they’ve far much less publicity to the know-how at its present stage.

Qualcomm and arm Their shares fell on Wednesday Emit light to guide present quarter.

Whereas each corporations have been speaking about their significance to synthetic intelligence purposes, the fact is that their publicity to the know-how continues to be very restricted.

Arm designs the blueprints for lots of the firm’s chips, and its semiconductors are utilized in a lot of the world’s smartphones. Whereas many electronics producers are speaking about artificial intelligence phonewhich doesn’t deliver essentially greater progress to chip designers.

The British firm nonetheless will get a big portion of its income from shopper electronics, moderately than the profitable knowledge facilities of AMD and Nvidia. Analysts have previously told CNBC Arm may benefit from synthetic intelligence as extra gadgets start to undertake AI know-how.

Qualcomm’s chips are utilized in smartphones, comparable to these made by Samsung, and the corporate nonetheless makes most of its income from cell phones. Like Arm, Qualcomm’s chips usually are not utilized in the kind of knowledge facilities the place LL.M.s are skilled.

The corporate’s chips might be Microsoft’s upcoming artificial intelligence computerHowever once more, this can be a long-term technique for Qualcomm.