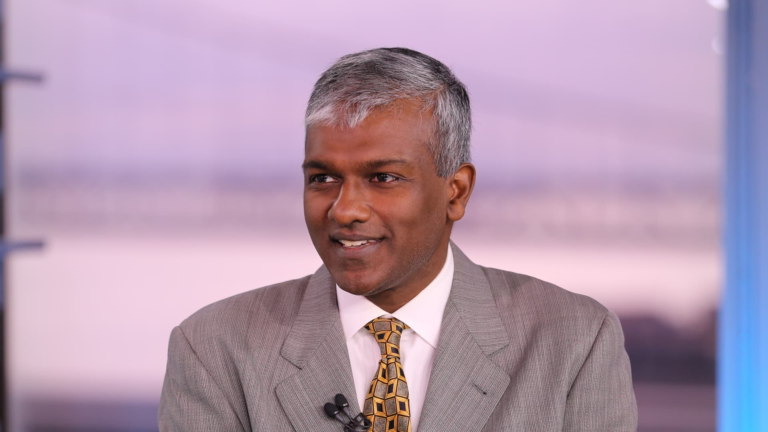

Hedge fund supervisor Dan Niles is betting that Apple and Meta Platform are two shares that may face up to a possible U.S. recession. Niles, who runs an actively managed fund of 20 to 40 U.S. large-cap shares at Niles Funding Administration, confused that whereas a recession isn’t his base case, buyers ought to concentrate on firms that may climate the difficult instances. financial situations of the corporate. He pointed to present financial indicators, akin to low unemployment, job alternatives, expectations for a fee reduce by the Federal Reserve and powerful GDP development, as causes for his optimism that the USA will keep away from recession within the brief time period. Nevertheless, Niles expressed a extra cautious outlook for the broader tech trade and the market as a complete. “My sense is that, for the market as a complete, we’ve not seen the underside of this correction but,” he warned, predicting that the market might backside in September as firms reassess their income sources and development prospects. . Niles highlighted the shift in investor expectations, noting that firms can now not rely solely on mentions of synthetic intelligence to spice up inventory costs. “The quarter ended badly,” Niles advised CNBC’s Squaw Field Asia on Friday. “You are [the companies] You really must show that you may generate earnings from all of those investments that you simply make, quite than simply discuss how nice it will likely be 5 to 10 years from now. . Among the many so-called “Massive Seven,” Niles singled out Apple and Meta as standout shares, he added. , solely these two shares really outperformed their earnings [earnings per share] He defined: “Income and earnings per share have grown in these 4 quarters.” Apple’s 1Y line is in sharp distinction to different know-how giants akin to Google and Microsoft, which didn’t report quarterly earnings per share development. Shares fall after lackluster forwards challenge Tesla shares have been on a downward pattern for the reason that firm introduced it was delaying its robotaxi service. income development will likely be very small. They purchased one throughout COVID,” Niles defined. “I feel income development subsequent yr might attain double digits, over 10%, as folks improve to AI-enabled smartphones. His forecast would put Apple’s earnings at their greatest degree since 2018,” He famous that along with a 33% improve in 2021 as a consequence of pandemic-related work-from-home restrictions, this upward pattern is more likely to persist even in a recessionary atmosphere, though the expansion fee will likely be decrease as a consequence of pent-up causes. Slower. He highlighted the corporate’s means to leverage synthetic intelligence successfully in its enterprise, Niles famous, saying Meta has efficiently built-in synthetic intelligence into its platform. [AI] Assist advocate content material you wish to see after which present you adverts they suppose you may really wish to watch. That is why you see them incomes greater than [and] Earnings per share [expectations]investing extra in synthetic intelligence, and there are nonetheless [forecast] Niles believes this technique, mixed with potential advert income from the upcoming U.S. presidential election, places Meta in a powerful place.

Subscribe to Updates

Get the latest creative news from FooBar about art, design and business.