Bitcoin has surged over the previous 24 hours, with the value again in direction of $57,000. In response to on-chain information, this can be the rationale behind it.

Exchanges obtain large stablecoin deposits forward of Bitcoin rally

in a brand new postal On X, market intelligence platform IntoTheBlock discusses vital Stablecoin Latest web inflows into exchanges.

The correlation metric right here is “exchange network traffic”, it tracks the online quantity of a given token or group of tokens shifting out and in of wallets related to centralized exchanges. The worth of this metric might be calculated by merely subtracting outflows from inflows.

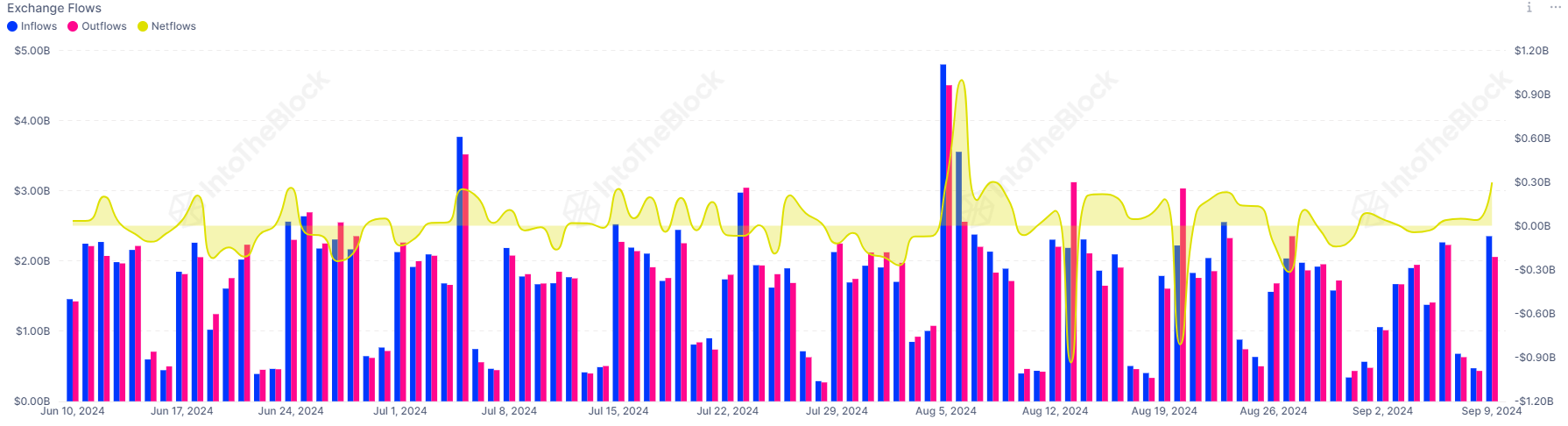

Beneath is a chart shared by IntoTheBlock exhibiting mixture trade web stream developments for all stablecoins over the previous few months.

Seems to be like the worth of the metric has been constructive in current days | Supply: IntoTheBlock on X

As proven within the chart above, stablecoin trade web flows have been at considerably constructive ranges not too long ago, which means buyers have been making giant web deposits to those platforms.

Usually talking, every time a holder desires to take part in buying and selling exercise, they switch their tokens from a self-custodial pockets to an trade. For a coin like Bitcoin, this sort of sell-off can come naturally bearish Impression on worth, so constructive web buying and selling flows might be seen as a nasty signal for the asset.

Nonetheless, within the present case, the cryptocurrencies in query are stablecoins, which differ from unstable cash as a result of buyers maintain them for various functions.

Usually, the principle cause for holders to stay secure is to avoid the volatility related to the remainder of the business, as the worth of those tokens stays round $1.

Stablecoin holders usually finally plan to enterprise into the unstable facet of the market, though they’ll hold their capital straight in fiat forex as if they didn’t.

When these buyers determine it’s time to change the commerce again to a extra unstable token, they could transfer it to an trade. This swap with Bitcoin and different currencies can naturally increase its worth, so constructive web stablecoin buying and selling flows might really be a bullish signal for the unstable token.

Yesterday, buyers deposited round $300 million of stablecoins into exchanges on-line, which means demand for purchasing belongings like Bitcoin is more likely to be excessive.

Since then, BTC has gained greater than 3%, surpassing the $57,000 mark. Given the timing, these stablecoin consumers doubtless performed at the very least some function within the rally.

Subsequently, stablecoin trade Netflow can be price watching within the close to future, as extra web deposits might imply a continued surge for Bitcoin.

bitcoin worth

Though Bitcoin has recovered considerably over the previous day, the present worth of $57,200 remains to be under the degrees it traded within the final week of August.

The value of the coin seems to have seen a big drawdown within the final couple of weeks | Supply: BTCUSD on TradingView

Featured pictures from Dall-E, IntoTheBlock.com, charts from TradingView.com