Creator: Saqib Iqbal Ahmed and Suzanne McGee

NEW YORK (Reuters) – The carefully watched debate between Republican Donald Trump and Democratic Vice President Kamala Harris on Tuesday night time left buyers with little readability on key coverage points, though post-game betting markets turned in favor of Harry Stimulus is favorable, however Wall Avenue stays nervous.

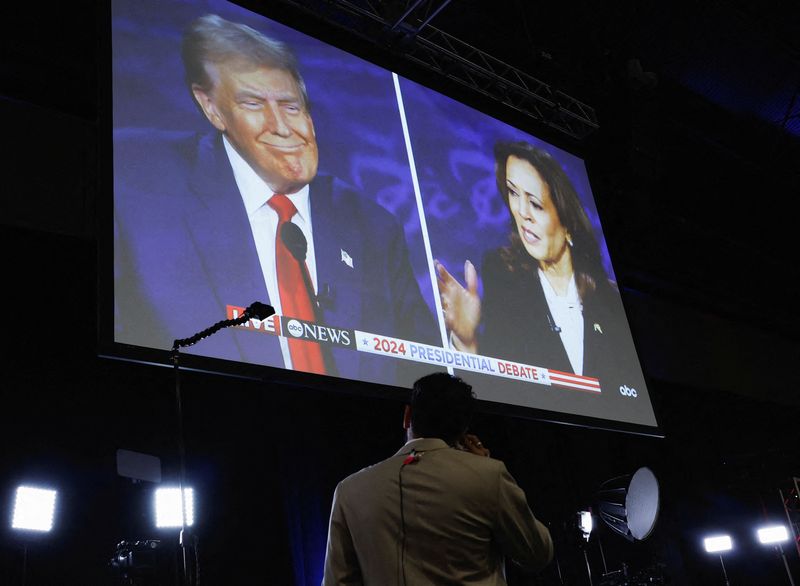

In a fiery debate, Trump and Harris clashed on all the pieces from the financial system to immigration and Trump’s authorized woes, as either side sought a campaign-changing second within the bitter race.

Their exchanges left buyers with few new particulars on points that would impression the market, together with tariffs, taxes and rules. Nonetheless, some observers stated Harris’ better-than-expected efficiency might proceed to have an effect on the costs of some property within the coming days if buyers imagine it can enhance her possibilities of profitable the White Home.

“Neither of them made a powerful financial argument, however total Harris has performed higher than Trump,” stated Eric Berridge, portfolio supervisor at Sound Earnings Methods in Westchester, New York. “The market did No sharp statements are wanted; they need readability.”

The 2024 presidential election market on the web prediction market PredictIt reveals that Harris’s likelihood of profitable has elevated from 53% earlier than the controversy to 56%, whereas Trump’s likelihood of profitable has dropped from 52% to 48%.

Asset costs reacted mutedly. Inventory index futures softened as the controversy progressed, with E-minis down 0.5% in early Asian commerce on Wednesday and E-minis down 0.6%.

The U.S. greenback index, which measures the buck’s power towards six main currencies, fell 0.2%.

Sonu Varghese, international macro strategist at Carson Group, stated: “I do not suppose this debate will change many individuals’s minds as a result of the citizens stays deeply divided. The one signal of that is Harry Si took the lead on prediction markets, however that also saved the marketing campaign going.”

Nonetheless, some buyers imagine even small shifts in candidate perceptions might have a big effect within the race for tens of hundreds of votes in a handful of states. The 2 candidates are just about tied in seven battleground states that would resolve the election, based on a mean of polls compiled by The New York Occasions.

Shier Lee Lim, chief FX and macro strategist for Asia Pacific at Convera, stated the controversy “doesn’t seem to have a major impression on markets to date, which is in step with comparatively low volatility expectations earlier than the occasion”. “That stated, this debate might nonetheless show to be an necessary catalyst in altering the electoral odds.”

Whereas the presidential race has largely been the main focus of buyers’ consideration, political issues have lately mixed with extra speedy market catalysts, together with issues that the U.S. financial system could also be weakening and uncertainty over the extent to which the Federal Reserve might want to lower rates of interest, buyers stated. Certainty. The S&P 500 posted its worst weekly proportion loss since March 2023 final week after a second consecutive disappointing jobs report, however the index remains to be up almost 15% this 12 months.

taxes and duties

Trump has promised to decrease company taxes and take a more durable stance on commerce and tariffs. He additionally stated a powerful greenback would harm the USA, however some analysts imagine his insurance policies might spur inflation and finally increase the forex.

Harris final month outlined plans to extend the company tax fee from 21% to twenty-eight%, a proposal that some on Wall Avenue imagine might harm company income.

On Tuesday night time, Harris attacked Trump’s intention to impose excessive tariffs on overseas items — a proposal she likened to a gross sales tax on the center class — whereas touting her plan to supply tax breaks for households and small companies.

Trump defended his proposed tariffs and stated they’d not end in greater costs for People.

The yuan, which has been below strain from the U.S.-China commerce warfare throughout Trump’s time period, edged greater towards the greenback.

Karl Schamotta, chief market strategist at Corpay in Toronto, stated: “Kamala Harris has efficiently swung the forecast market odds in her favor, supporting a benign however broad-based danger urge for food throughout forex markets. enhance.

Trump additionally criticized Harris for persevering with inflation below the Biden administration. Inflation, he stated, “is a catastrophe for individuals, for the center class, for each class.”

Nonetheless, financial coverage might stay up within the air for a while.

“There hasn’t been lots of substantive coverage dialogue,” stated Carson Group’s Varghese. “Each candidates advocate for radically totally different financial insurance policies than these presently in place. Finally, most of the financial insurance policies we see enacted subsequent 12 months will depend upon the composition of the Senate and Home of Representatives.”