A senior Biden administration official stated the U.S. Division of Schooling doesn’t plan to start forgiving as a lot as $147 billion in scholar debt. 25 million Americans Earlier than this system’s remaining guidelines are launched—though claim Seven Republican state attorneys common did the alternative.

These attorneys common final week satisfied a Georgia decide to quickly block the president Joe BidenNew forgiveness program for federal scholar loans, claims Division of Schooling tried to implement program in secret earlier than remaining guidelines have been launched October.

AG is in litigation Questioning the legality of the plan, claims schooling minister Michael Cardona “Quietly issuing orders to mortgage servicers to start mass cancellations as quickly as this week” would violate laws requiring a remaining rule to be issued first.

However Biden administration officers informed CNBC that the Schooling Division is solely instructing mortgage servicers to arrange for debt cancellation.

“We won’t implement any guidelines till they’re finalized,” the official stated.

An individual accustomed to the lending business confirmed this to CNBC and stated the Power Division was merely telling servicers to arrange for the debt aid program.

These preparations embody briefing customer support brokers on methods to clarify support to debtors when it turns into obtainable and drafting new web site messaging.

“It is a essential and essential preparation,” the supply stated. “It is much like any kind of product launch.”

“The service employees weren’t given excusing paperwork,” the supply stated.

However a spokesperson for the Missouri Lawyer Common’s Workplace, one of many lawsuit’s plaintiffs, stated in an e mail to CNBC when requested about feedback from Biden officers and sources, “We have now proof on the contrary, which we now have filed beneath seal. .

“It stays sealed till the division agrees to unseal it,” the spokesman stated. “It’s clear that the division has up to now refused to comply with the discharge of this proof.”

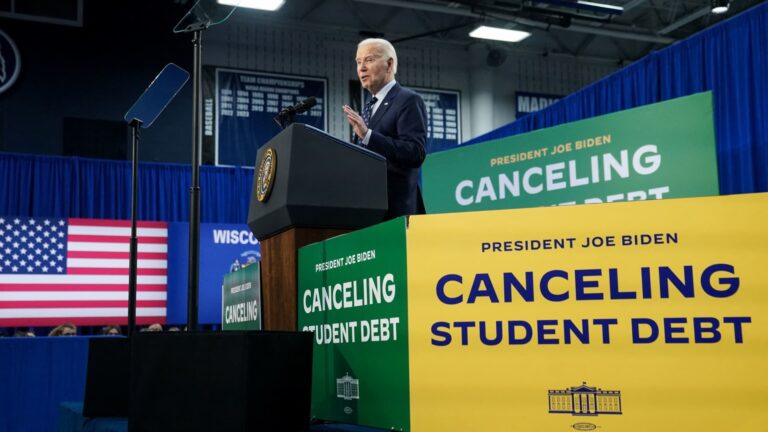

The plan was the Biden administration’s third effort to forgive scholar debt, nevertheless it was in the end stymied by a Republican-led authorized problem.

In June 2023, the Supreme Courtroom dominated that the administration’s first try to cancel as much as $400 billion in scholar debt with out prior authorization from Congress was unconstitutional.

Two months in the past, a federal appeals court docket quickly halted Biden’s new inexpensive compensation plan for scholar mortgage debtors, referred to as “SAVE.” Some Republican-led states argued that the Division of Schooling and SAVE have been basically looking for a roundabout option to forgive scholar debt within the wake of the Supreme Courtroom’s ruling.

In a brand new lawsuit filed in U.S. District Courtroom in Augusta, Ga., over the third aid bundle, seven states argue that the Biden administration’s mortgage forgiveness program violates the U.S. Structure’s separation of powers provisions by searching for to extend income with out growing Debt case cancellation of billions of {dollars} in debt.

Along with Missouri, the states submitting the lawsuit are Alabama, Arkansas, Florida, Georgia, North Dakota and Ohio.

Thursday, when he posted temporary restraining order U.S. District Choose Randal Corridor blocked the brand new program from taking impact, writing that the lawyer common “has obtained paperwork displaying that the secretary is implementing this clemency program … however has not launched it and has not completed so since Might.” Begin doing this.

Corridor wrote that states have “proven a considerable chance of success” within the lawsuits provided that “the secretary of state is searching for to impose guidelines that violate regular procedures.”

Corridor plans to carry a listening to on the lawsuit subsequent week.

Larger schooling skilled Mark Kantrowitz informed CNBC it is regular for administrations to take steps to arrange for brand new laws.

“The preparations aren’t towards the regulation,” Kantrowitz stated. He additionally stated that “forgiveness shouldn’t be potential till the principles are finalized.”

Even when Corridor finds that the Biden administration didn’t violate the regulatory timeline, he may nonetheless veto the debt aid plan as unconstitutional or on different grounds.

However customers and authorized advocates fear that Corridor has shortly embraced states’ claims that the Biden administration improperly rushed this system.

“There’s been a rise within the permissive construction for conservative judges to make one thing up that does not even have to be based mostly on sound precept or precedent,” stated Luke HerringAssistant Professor of Regulation, College of Alabama.