On-chain knowledge reveals that Bitcoin’s lively handle indicator has lately fallen to very low ranges. What this might imply for asset costs.

Bitcoin’s 30-day MA lively addresses have now dropped to 1 million

As CryptoQuant writer Axel Adler Jr explains in a brand new article postal X, BTC active address This indicator has been trending downward lately. Because the title suggests, this metric measures the overall variety of addresses that take part in some sort of transaction exercise on the Bitcoin blockchain every single day.

The variety of distinctive addresses lively might be thought of the identical because the variety of distinctive customers interacting with the community, so the worth of this metric can inform us how a lot visitors BTC is at present dealing with.

When the worth of this indicator will increase, it implies that the variety of customers utilizing the community is rising. Such developments imply that blockchain is at present attracting consideration. Alternatively, declining indicators recommend that investor curiosity in cryptocurrencies could also be declining as buying and selling customers decline.

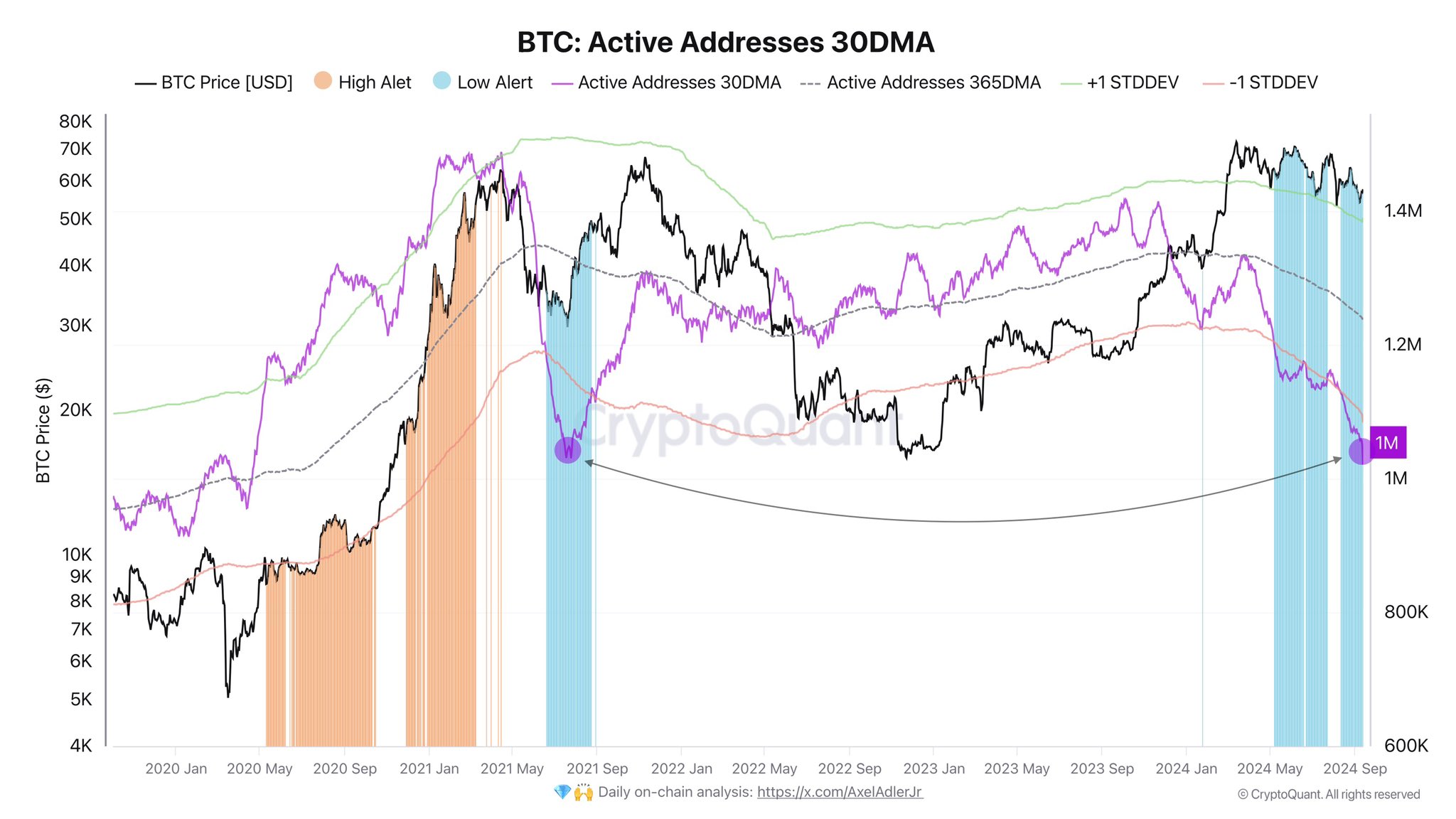

Now, the chart beneath reveals the development of the 30-day and 365-day transferring averages (MA) of Bitcoin’s lively addresses over the previous few years:

The worth of the metric seems to have been on the decline in latest months | Supply: @AxelAdlerJr on X

As you possibly can see from the chart above, the 30-day transferring common of Bitcoin’s lively addresses has been declining over the previous 12 months. The indicator quickly deviated from this downtrend through the worth rally to all-time highs (ATH), however has returned to regular because the asset fell into consolidation.

Traders discover dramatic worth strikes like rallies thrilling, so it is no shock that the value surge earlier this 12 months rapidly attracted numerous consideration. Nevertheless, the lackluster worth motion that adopted quickly made customers lose curiosity.

Shortly after the 30-day transferring common lively handle resumed its downward trajectory, its worth fell beneath the 365-day transferring common, and the 2 traces have maintained this association since then.

This implies that Bitcoin’s latest month-to-month exercise has been beneath common over the previous 12 months. In reality, lively addresses are at present value round 1 million, and the 30-day transferring common is at the same degree to 2019 ranges. July 2021.

July 2021 Downturn as China bans Bitcoin miningwhich has adversely affected the value of cryptocurrencies. Nonetheless, lively addresses did not keep at these lows for lengthy, and a bull run emerged because the community got here again to life Second wave.

Traditionally, any sustainable motion in an asset requires a rise in lively addresses, because the addition of recent customers supplies the gas wanted to maintain such operations going. Due to this fact, Bitcoin could not see one other lasting rally now both earlier than lively addresses bounce again.

bitcoin worth

Earlier within the day, Bitcoin had climbed again above $58,000, however the asset seems to be slipping once more as its worth at present stands at $57,700.

Appears to be like like the value of the coin has been going up over the previous couple of days | Supply: BTCUSDT on TradingView

Featured photographs from Dall-E, CryptoQuant.com, charts from TradingView.com