The day after the Fed assembly, buyers piled into know-how shares on the quickest tempo this 12 months Lower base interest rates For the primary time since 2020.

The inventory worth rose 7.4%, pushed by Tesla and a 4% bounce NVIDIAOn Thursday, the Nasdaq rose 2.5%, its fourth-largest acquire of 2024.

Decrease rates of interest have a tendency to learn know-how shares, as decrease borrowing prices and bond yields make enterprise capital extra enticing. Along with the central financial institution chopping rates of interest by half a share level, the Federal Open Market Committee additionally “Point Picture” That may be equal to a different 50 foundation factors minimize by the tip of the 12 months, in the end 2 share factors decrease than Wednesday’s minimize.

Whereas the Nasdaq has risen steadily this 12 months, pushed by enthusiasm for Nvidia and synthetic intelligence, Thursday’s beneficial properties pushed the benchmark to its highest degree since mid-July. The Nasdaq reached a peak of 18,647.45 factors on July 10 and is at present solely 3.5% under that degree, closing at 18,013.98 factors.

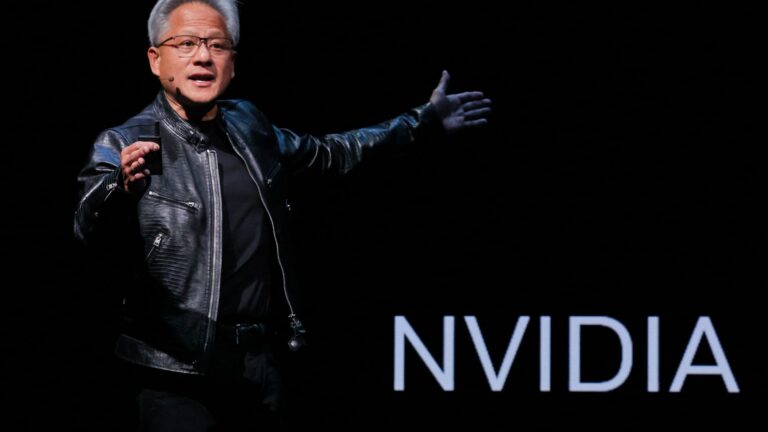

Nvidia, whose processors energy the generative AI increase and companies like OpenAI’s ChatGPT, rose 4% to $117.87 on Thursday. The inventory is up about 138% this 12 months after greater than tripling in 2023, however stays 13% under its all-time excessive set in June.

Nvidia depends on a comparatively small buyer base—i.e. Microsoft, Yuan, letter, Amazon, Oracle OpenAI – The income is large as a result of these corporations both develop massive language fashions, host massive AI workloads, or each. Any signal of weakening demand might result in concern surrounding Nvidia inventory.

However decrease rates of interest are seen as one other potential profit.

Fellow chip producers AMD and Broadcom Additionally they rose sharply on Thursday, rising 5.7% and three.9% respectively. AMD is making an attempt to problem Nvidia within the synthetic intelligence market, nevertheless it’s lagging far behind and elevating some skepticism on Wall Avenue. The inventory is up solely about 6% this 12 months.

AMD CEO Lisa Su informed CNBC’s Jim Cramer on Wednesday that synthetic intelligence is a protracted recreation and we’re within the early levels.

“Let’s not be impatient. Expertise developments ought to final for years, not months,” Su mentioned. “We have solely been within the ChatGPT world for about 18 months. We’re all studying. It is enjoyable. We’re all utilizing it.”

Synthetic intelligence will enter “each side of our lives,” together with training and drug improvement, Su mentioned.

“The fantastic thing about all of it is that you could calculate, and that is precisely what we did,” Su mentioned.

Tesla was the largest gainer amongst tech giants on Thursday, rising 7.4%. The electrical automobile maker has lagged this 12 months, down almost 2%, in contrast with the Nasdaq’s 20% acquire. Nonetheless, Tesla shares are up 72% from the 12 months’s low in April.

Amongst different high know-how corporations, apple and Yuan Additionally they rose sharply on the shut, each up almost 4%.