Regardless of some mid-week turbulence, Bitcoin (BTC) value rebounded toIn accordance with knowledge from CoinMarketCap, the general value elevated by 4.07% over the previous week. This constructive value efficiency has stored Bitcoin on final week’s upward trajectory. Price breaks above $60,000 mark. Nonetheless, amid the value features, there stays widespread uncertainty over whether or not the cryptocurrency market chief has now entered a bullish pattern.

Associated studying: Bitcoin bull run begins: Experts point to huge upside potential in coming months

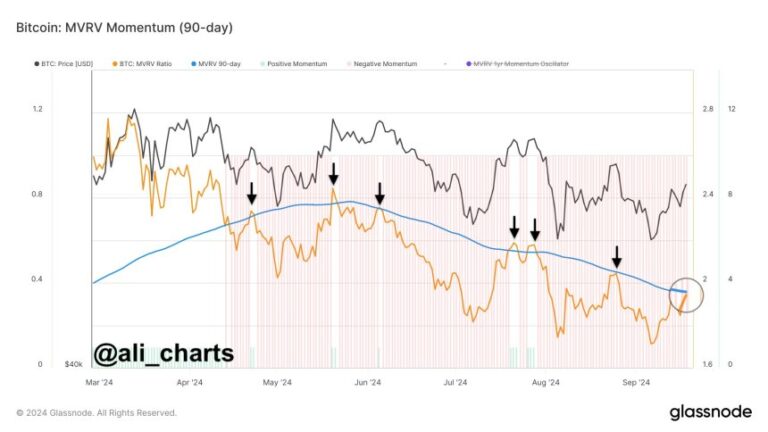

Analysts say Bitcoin MVRV pattern is vital to bull market

On Friday, well-liked cryptocurrency analyst Ali Martinez shared This market situation would mark a return to the bullish section for Bitcoin. The highest cryptocurrency has gained greater than 23% prior to now two weeks, rising from round $52,800 to a peak of $64,041.

Nonetheless, Martinez posits that the Bitcoin Market Worth to Realized Worth (MVRV) ratio would wish to shut above the 90-day transferring common to substantiate a bullish pattern, after weeks of sideways strikes in July and August. . Typically talking, the MVRV ratio is used to judge Bitcoin market tendencies, with a excessive ratio indicating that the asset could also be overvalued and a low ratio indicating that the asset is undervalued.

When Bitcoin’s MVRV is beneath its 90-day transferring common (i.e. the typical MVRV for that interval), it signifies that the asset is in a correction or bearish section and traders could also be holding on to unrealized losses, which may shortly flip unfavorable temper. In distinction, when MVRV is above the 90-day transferring common, it alerts bullish momentum as Bitcoin’s market capitalization rises above its historic common.

Ali Martinez posits that the latter situation must occur to gas a bullish flip for Bitcoin regardless of the current market rally. If this occurs, BTC may surge to highs of $68,000-70,000, which is the subsequent vital degree of resistance. On this case, the main cryptocurrency is more likely to Septembera month recognized for bearish returns.

New $2 Billion BTC Futures Contract Has Potential Bull Squeeze Threat

In different information, Bitcoin merchants opened about $2 billion in futures contracts within the 48 hours following Bitcoin’s current value surge. Whereas this growth signifies excessive curiosity in Bitcoin, it additionally represents a big rise in leveraged positions. Ali Martinez state This example carries the danger of a protracted squeeze, that’s, if the value of BTC falls, these merchants’ positions could also be compelled to be liquidated, inflicting downward strain on the value of Bitcoin.

As of this writing, BTC continues to commerce at $62,875, down 1.59% over the previous day. In the meantime, the asset’s each day buying and selling quantity fell by 16.75% and is value $36.4 billion.

Featured picture from The Motley Idiot, chart from Tradingview