Information exhibits that the Bitcoin Coinbase Premium Index has surged lately, suggesting it might be partially behind the newest value surge.

Bitcoin Coinbase Premium Index Now Reveals Important Constructive Worth

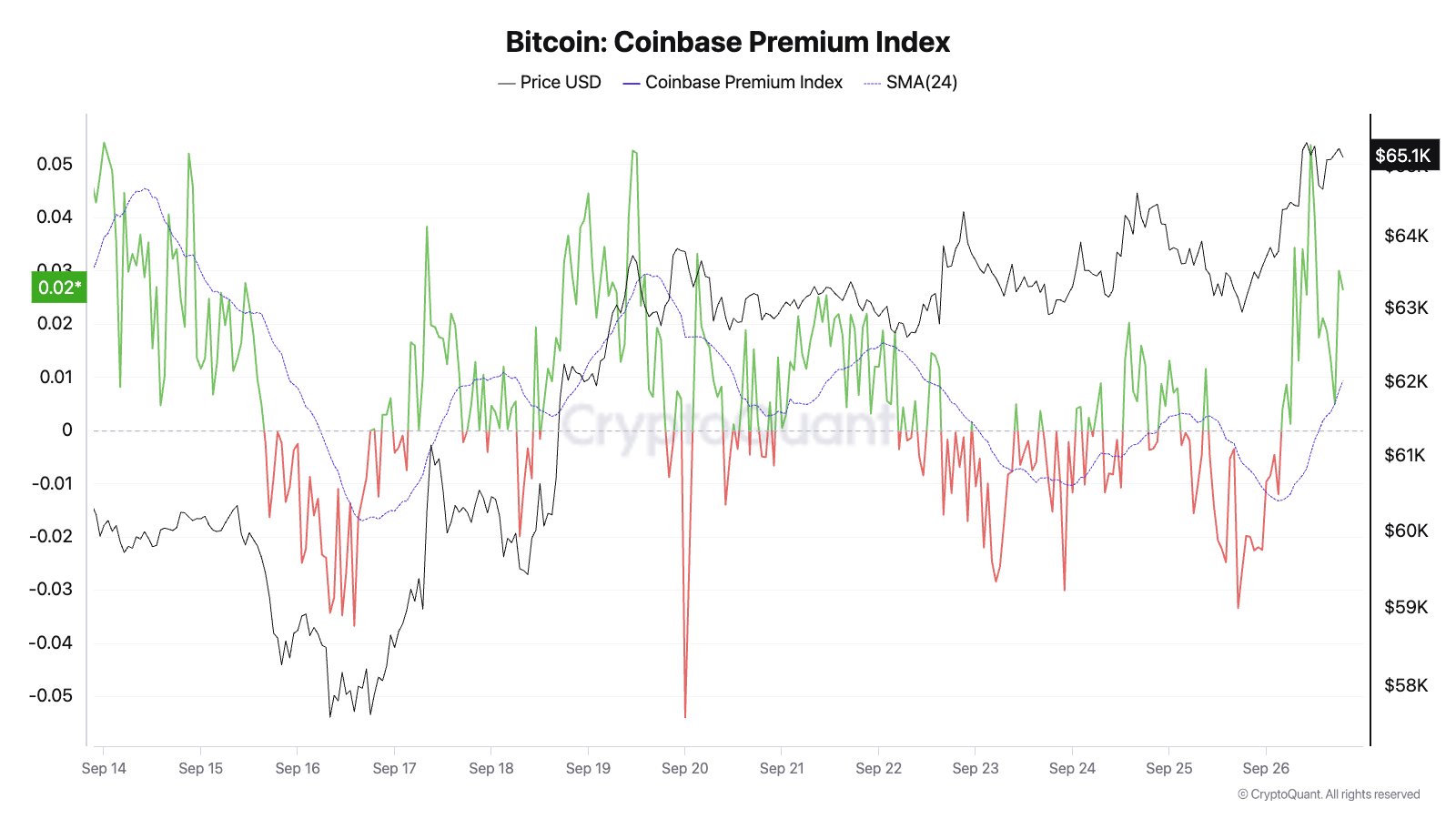

As Julio Moreno, head of analysis at CryptoQuant, factors out in a brand new report postal On Day X, the BTC Coinbase Premium Index lately surged into optimistic territory. this”Coinbase Premium IndexThis refers to an indicator that tracks the share distinction between Bitcoin costs listed on Coinbase (USD pair) and Binance (USDT pair).

Associated studying: US Platform Retakes Bitcoin Holding Dominance: Is It Bullish?

When the worth of this indicator is optimistic, it implies that the asset is presently buying and selling at a better value on Coinbase than on Binance. This pattern signifies that the previous observes larger shopping for strain or decrease promoting strain than the latter. Alternatively, the metric being beneath zero implies that Coinbase customers are presently concerned in additional promoting than Binance customers.

Now, beneath is a chart shared by Moreno exhibiting the pattern of the Bitcoin Coinbase Premium Index over the previous few weeks:

The worth of the metric seems to have surged into the optimistic area lately | Supply: @jjcmoreno on X

As proven within the chart above, the Bitcoin Coinbase Premium Index had earlier fallen into detrimental territory, however as latest rally Asset costs rose sharply and returned to optimistic territory. This means that Coinbase buyers have been taking part in accumulating holdings, and that this shopping for could also be not less than partly chargeable for the token’s surge.

Coinbase is the primary platform for US buyers, particularly massive institutional entities, whereas Binance serves world visitors. Subsequently, the Coinbase Premium Index primarily displays the variations within the conduct of U.S. buyers versus these in different components of the world.

Cryptocurrencies have been intently watching this metric to this point in 2024, which means US whales have been driving value motion. So it’s no shock that the brand new rally continues the identical pattern.

The Coinbase Premium Index is presently rising, however could also be price watching within the close to future as its worth might flip shortly. If it does, Bitcoin might additionally expertise a bearish wind, because it has already executed many instances this 12 months.

In another information, Bitcoin is now approaching its ultimate price base short term holders As CryptoQuant writer Axel Adler Jr discusses in X postal.

The Realized Worth of the assorted short-term holder segments | Supply: @AxelAdlerJr on X

These short-term holders bought the tokens three to 6 months in the past and presently have a mean price foundation of $66,300. If Bitcoin can transfer past this degree, all short-term holders (i.e. those that purchased throughout the previous six months) will return to profitability.

bitcoin value

As of this writing, Bitcoin is buying and selling round $65,700, up greater than 3% over the previous week.

Appears like BTC has been on the best way up over the previous few days | Supply: BTCUSDT on TradingView

Featured photos from Dall-E, CryptoQuant.com, charts from TradingView.com