Bitcoin’s value has been constructive once more over the previous seven days, with an excellent stronger efficiency anticipated on the finish of the month and the beginning of October. The main cryptocurrency has continued its restoration over the previous few weeks, climbing to $66,000 on Friday, September 27.

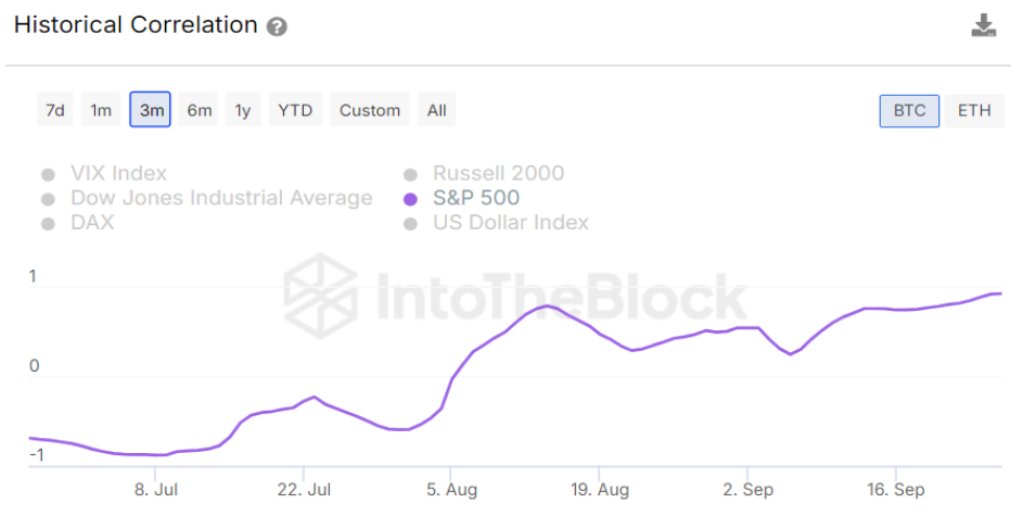

Current information suggests there could also be a rising correlation between the efficiency of U.S. shares and the worth of the world’s largest cryptocurrency. The query right here is─How does this have an effect on investor behavior?

How did Bitcoin and the S&P 500 carry out in September?

In a latest article on Platform X, crypto intelligence firm IntoTheBlock disclose The correlation between the worth of Bitcoin and the S&P 500, one of the standard inventory market indexes, has reached its highest level in additional than two years. For readability, the S&P 500 Index tracks the efficiency of the five hundred largest exchange-listed firms in the US.

Bitcoin value has seen a surprisingly constructive efficiency in September, a month that has traditionally been bearish for the flagship cryptocurrency. Based on information from CoinGecko, the worth of BTC has elevated by greater than 11% up to now month.

Supply: IntoTheBlock/X

on the similar time, S&P 500 Index It has skilled a fast and powerful restoration, reaching new all-time highs after an preliminary downturn earlier this month. The index rose practically 4% in September, in accordance with TradingView.

The connection between the inventory market and the inventory market cryptocurrency market It is at all times attention-grabbing as traders look to benefit from the alternatives supplied by both market. Nevertheless, the sturdy correlation between the 2 asset courses is assumed to slim the diversification alternatives they provide traders.

As of this writing, Bitcoin is buying and selling at round $66,024, up simply 1.1% up to now 24 hours. In the meantime, the S&P 500 continues to hover round 5.8K, up 0.4% over the previous day.

World liquidity surges by $1.426 trillion per week

In style Cryptocurrency Knowledgeable Ali Martinez Makes use of X Platform share The quantity of capital in international monetary markets has surged considerably. Knowledge offered by Martinez confirmed that international liquidity elevated by $1.426 trillion up to now week.

World liquidity surged by $1.426 trillion this week, reaching $131.6 trillion. #bitcoin and different threat belongings are rising, though this elevated liquidity is more likely to proceed into October. pic.twitter.com/PtFDjkR7wU

— Ali (@ali_charts) September 27, 2024

Bitcoin and different threat belongings have been the primary beneficiaries of rising international liquidity, as elevated capital inflows have induced their worth to rise. Martinez additionally famous that this enhance in liquidity could proceed into October.

The value of BTC breaks above $66,000 on the day by day timeframe | Supply: BTCUSDT chart from TradingView

Featured picture from iStock, chart from TradingView