Bitcoin worth has been beneath intense bearish stress over the previous few weeks, the cryptocurrency researcher explains The role of demand in market adjustment.

Obvious demand for Bitcoin is declining – ought to I be alarmed?

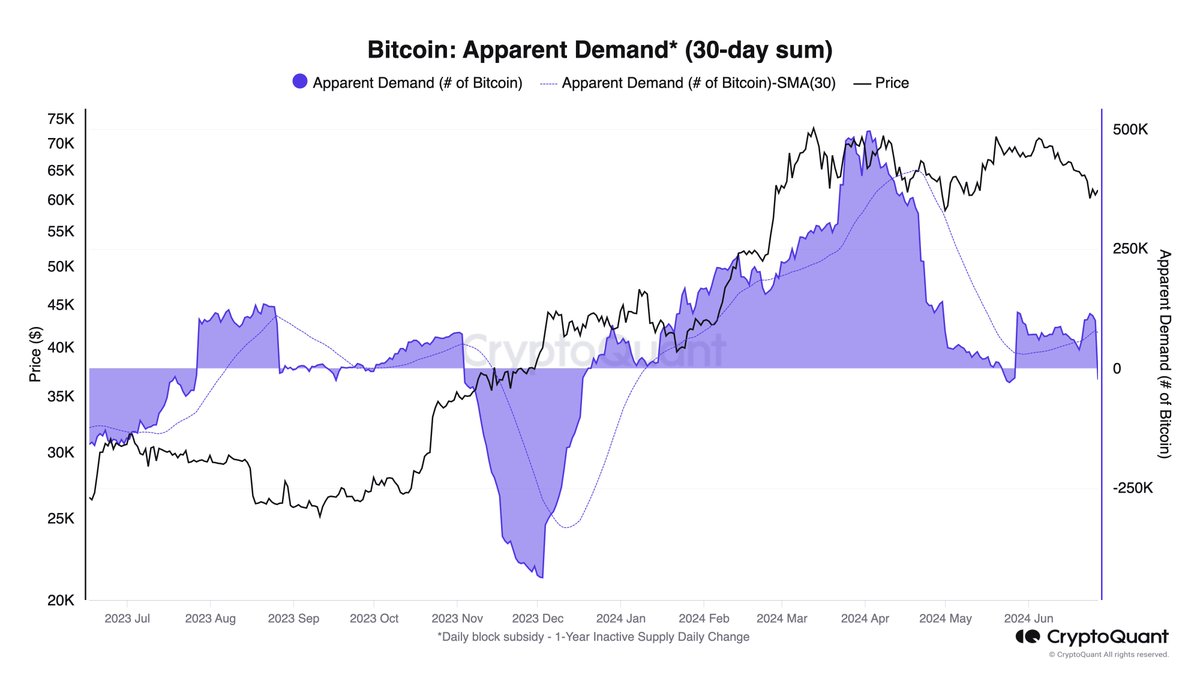

Julio Moreno, head of analysis at CryptoQuant, lately printed an article on the X platform explained How the most recent Bitcoin worth correction correlates with falling demand for Bitcoin. The evaluation relies on the Bitcoin obvious demand indicator on the CryptoQuant platform.

Obvious demand calculations are generally utilized in monetary markets to evaluate demand by evaluating manufacturing ranges and stock adjustments. Principally, this indicator clearly reveals whether or not demand is rising or falling.

Within the case of cryptocurrencies equivalent to Bitcoin, obvious demand is calculated by using the idea of inactive provide. This idea tracks the quantity of Bitcoin that has not been moved or transferred inside a sure time frame.

As Moreno highlighted, the chart beneath makes use of 1 12 months of inactive provide as an “stock proxy.” This implies it screens the variety of Bitcoins that haven’t moved or been traded in additional than a 12 months.

Chart displaying BTC obvious demand and worth | Supply: jjcmoreno/X

Based on information from CryptoQuant, roughly 23,000 BTC have flowed out of the 1-year inactive provide prior to now 30 days. This reveals declining demand for Bitcoin long term investor Select to uninstall and switch their Bitcoins.

The drop in demand has a number of results, significantly on the worth of main cryptocurrencies. For instance, CryptoQuant’s head of analysis pointed to sluggish demand as one of many catalysts for the latest worth correction.

The inflow of Bitcoin into the market from long-term holders will increase the accessible provide, placing downward stress on the worth. As well as, when shopping for stress available in the market is inadequate to soak up the extra provide, it might trigger costs to fall.

CryptoQuant revealed in a weekly report that Bitcoin demand fell considerably in comparison with the primary quarter following the launch of Bitcoin in the US Spot ETFs. As a result of present worth drop, elevated demand for Bitcoin seems to be a catalyst for the resumption of the present bull market.

Bitcoin Worth at a Look

As of this writing, Bitcoin worth is round $60,790, down 1.6% over the previous week. The market chief has misplaced almost 6% over the previous week, based on CoinGecko information.

The worth of BTC thickens across the $60,000 mark on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView