Knowledge reveals that Bitcoin dominance on U.S. exchanges is rising. That is what occurred the final two instances this pattern occurred.

Bitcoin is transferring from a world platform to a U.S. platform

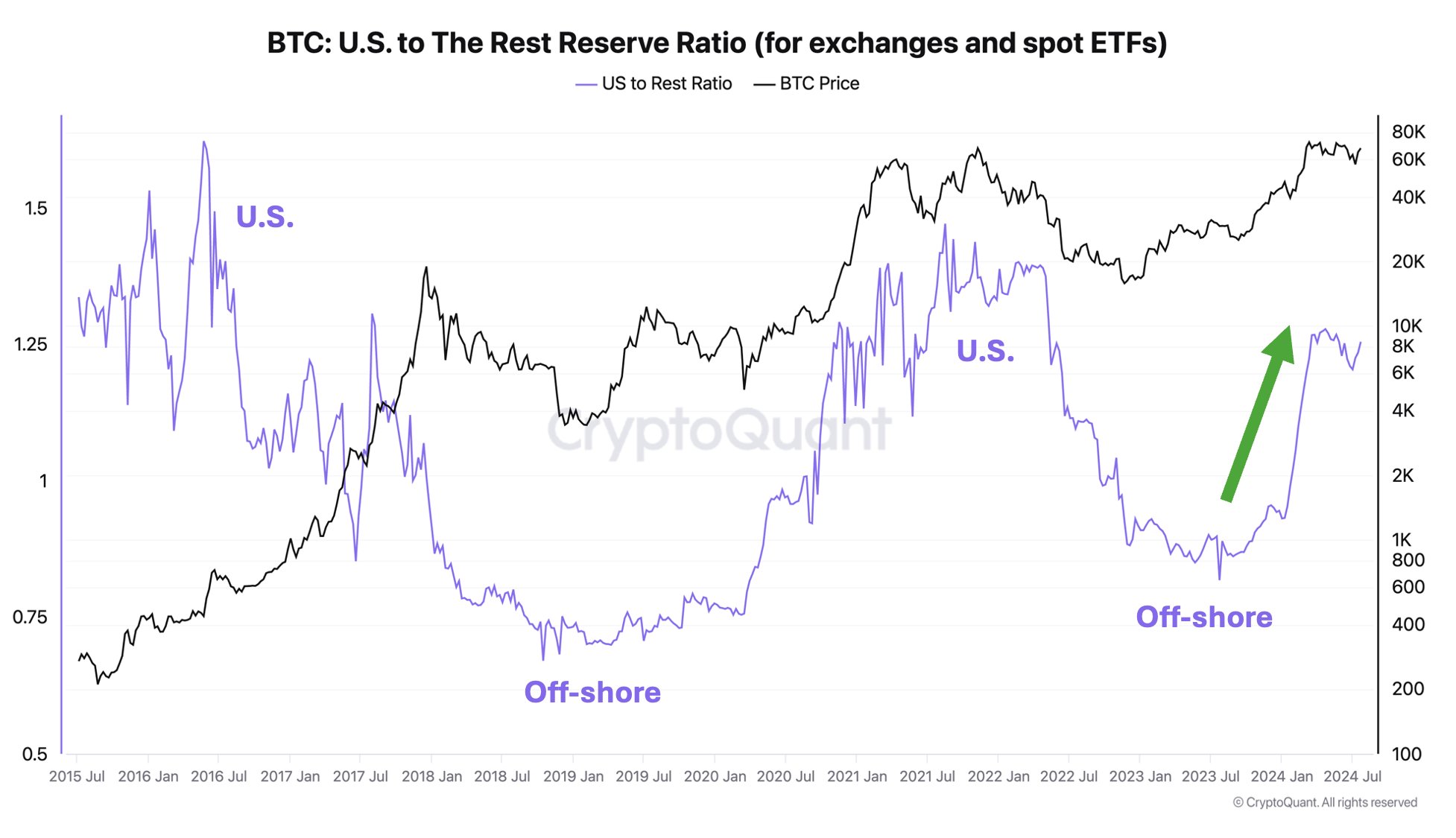

in a brand new postal On X, CryptoQuant founder and CEO Ki Younger Ju discusses latest tendencies rising in Bitcoin indicators. The metric in query is the ratio between Bitcoin reserves on U.S. platforms and offshore platforms.

The “platform” right here contains not solely exchanges, but in addition Spot Exchange Traded Funds (ETFs)was solely authorised to function in america in January this yr.

When the worth of this ratio will increase, it implies that the reserves of U.S. platforms enhance relative to offshore platforms. This pattern might point out that curiosity is shifting from the latter to the previous.

However, the declining indicator implies that cryptocurrencies could also be transferring from U.S. exchanges and spot ETFs to international platforms.

Now, the chart beneath reveals the pattern of this Bitcoin metric over the previous decade:

The worth of the metric seems to have noticed a pointy enhance lately | Supply: @ki_young_ju on X

As proven within the chart above, the ratio fell to comparatively low values through the 2022 bear market and 2023 restoration, however this yr the indicator’s worth has risen sharply.

Because of this the dominance of offshore platforms has declined considerably. The primary driver of this pattern will be the recognition of U.S. spot ETFs since their launch.

It may be seen from the chart that in Bull market in 2021. World exchanges dominated the bear market and subsequent restoration section, however then a shift to U.S. platforms occurred, which paved the way in which for larger costs.

The dominance of U.S. exchanges additionally rose quickly through the 2017 bull market buildup, so it appears seemingly that BTC will undergo a bull interval when curiosity in U.S. platforms outweighs curiosity in the remainder of the world.

For the reason that ratio has fashioned this sample once more lately, the cryptocurrency could possibly be headed for an additional large bull run. Now, it stays to be seen whether or not this pattern will repeat.

In another information, loads of lengthy buyers meet liquidation The derivatives area has seen losses over the previous 24 hours as Bitcoin and different cash skilled a retracement.

The information for the mass liquidation occasion that has occurred within the crypto market through the previous day | Supply: CoinGlass

As proven above, on this window, roughly $173 million in cryptocurrency-related contracts have been liquidated, of which greater than $148 million have been lengthy positions.

bitcoin value

Bitcoin briefly fell beneath the $66,000 degree throughout its newest plunge, however the asset has since seen some minor restoration to $66,600.

Appears to be like like the worth of the coin has seen a pointy plunge over the previous day | Supply: BTCUSD on TradingView

Featured photos from Dall-E, CryptoQuant.com, CoinGlass.com, charts from TradingView.com