On-chain knowledge exhibits that Bitcoin’s hashrate has retreated lately because the cryptocurrency’s value continues to bearish.

Bitcoin Mining Hashrate Has Retraced August Restoration

this”Mining computing power” refers back to the Bitcoin metric that tracks the full quantity of computing energy presently linked to the BTC community by miners.

When the worth of this indicator will increase, it implies that new miners are becoming a member of the blockchain and/or previous miners are including their amenities. This development implies that the community seems to be a gorgeous enterprise for these chain validators.

Alternatively, the declining indicator implies that some miners have determined to go away the blockchain, probably as a result of BTC mining is not worthwhile for them.

Now, it is a image from Blockchain network Reveals the adjustments in common Bitcoin mining energy over the previous seven days over the previous yr:

Appears like the worth of the metric has gone down in latest days | Supply: Blockchain.com

As will be seen from the chart above, the seven-day common of Bitcoin mining hashrate elevated in the course of final month and has returned to a degree not removed from the all-time excessive (ATH) set in July.

Nonetheless, in direction of the tip of the month, the indicator started to say no and has now returned to virtually the identical lows as in early August.

The reason behind these traits could lie in miners’ reliance on the Bitcoin spot value to generate earnings. It’s because block subsidythe compensation they obtain for fixing blocks on the community makes up a serious a part of their revenue.

These rewards are issued at a set BTC worth and at mounted time intervals, so the one variable related to them is the USD value of the cryptocurrency. With costs battling bearish winds once more lately, it is sensible for miners to cut back operations.

Nonetheless, as has been the case traditionally, the latest decline within the seven-day common of Bitcoin mining hash price could not final lengthy, and any new value surge might refresh the metric’s upward development.

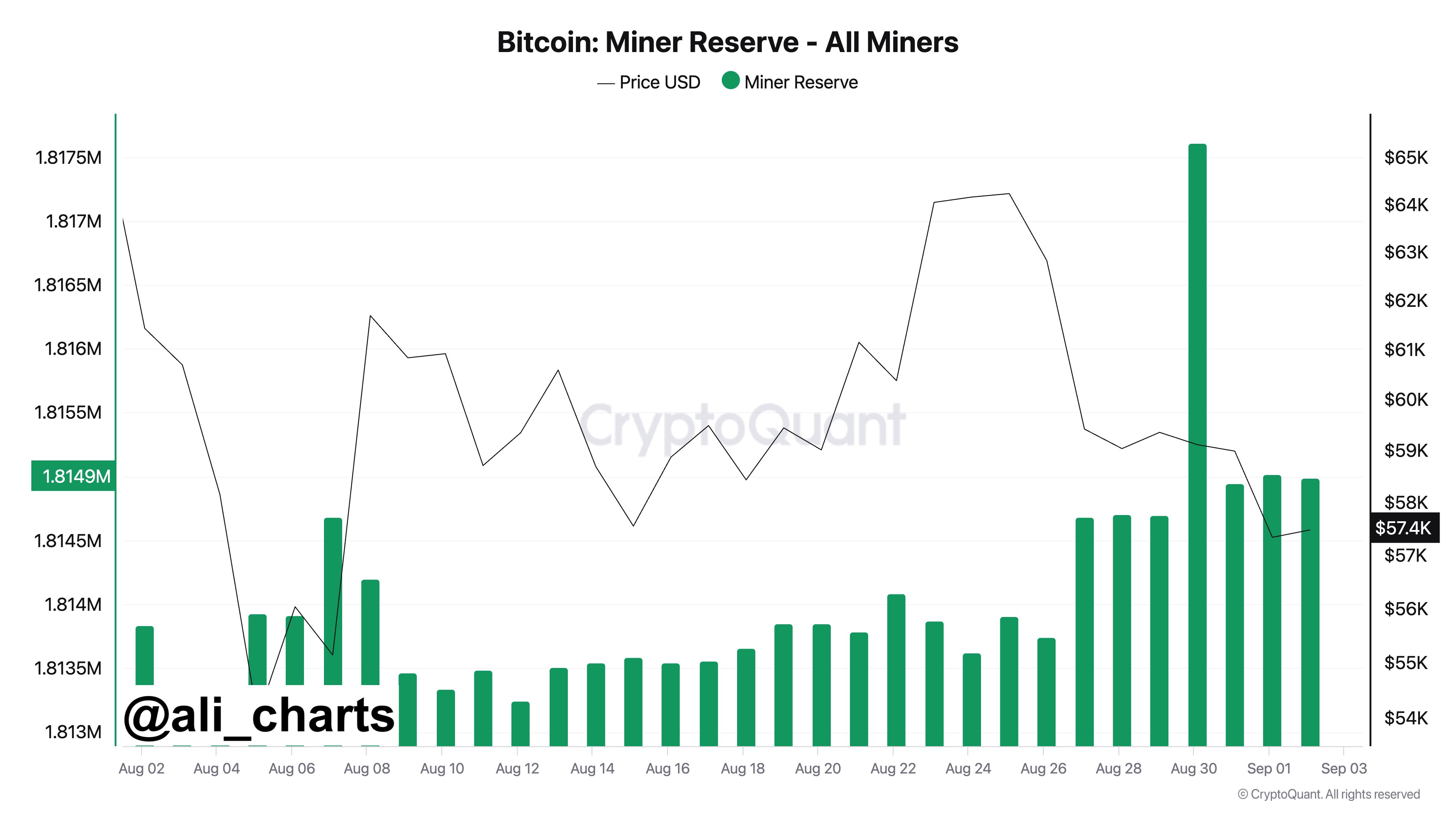

Along with computing energy, one other indicator that will present the miners’ plight is miners reservewhich measures the full quantity of Bitcoin presently situated in wallets related to these chain validators.

As analyst Ali Martinez famous in X postalMiners participated in heavy promoting over the weekend.

The development within the BTC Miner Reserve over the previous month | Supply: @ali_charts on X

Throughout this era, Bitcoin miners withdrew a complete of two,655 BTC from wallets, which is value greater than $156 million at present cryptocurrency alternate charges.

bitcoin value

As of this writing, Bitcoin is buying and selling round $59,000, down greater than 5% up to now seven days.

The worth of the coin seems to have been shifting sideways over the previous few weeks | Supply: BTCUSD on TradingView

Featured pictures from Dall-E, CryptoQuant.com, Blockchain.com, charts from TradingView.com