A well-liked cryptocurrency analyst explains how bitcoin price Primarily based on the present distribution of Bitcoin provide round worth, there could also be a threat of additional declines.

This Bitcoin worth vary poses a key provide barrier

in the latest postal On the X platform, outstanding cryptocurrency knowledgeable Ali Martinez mentioned that Bitcoin’s worth might undergo extra declines. The rationale behind this bearish forecast revolves across the cost-averaging foundation of a number of Bitcoin buyers.

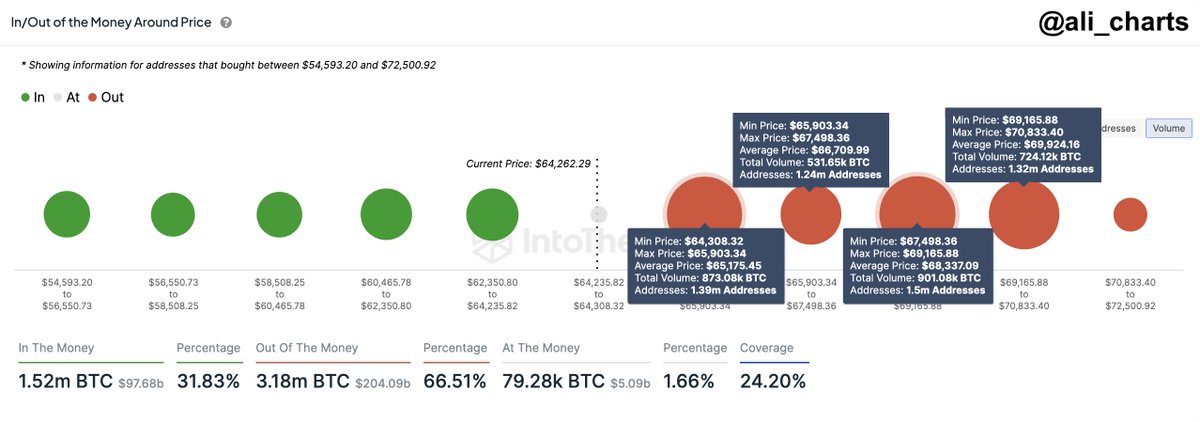

Information from IntoTheBlock exhibits that roughly 5.45 million addresses bought roughly 3.03 million BTC within the worth vary of $64,300 to $70,800. As Martinez highlighted, this leads to the creation of a essential provide barrier on this worth vary.

For context, a provide barrier refers back to the worth vary at which massive quantities of a cryptocurrency may be obtained. Judging by the dimensions of the dots within the chart beneath, Bitcoin seems to have a big provide obstacle in the meanwhile.

A graph exhibiting the distribution of BTC provide round numerous worth ranges | Supply: Ali_charts/X

This worth vary turns into significantly essential when Bitcoin costs fall beneath this stage, as Bitcoin holders throughout the provide barrier might begin promoting to chop their losses. This might trigger promoting stress to accentuate and will lead to a bigger worth correction for the main cryptocurrency.

Moreover, large-scale sell-offs and sustained worth declines can negatively impression market sentiment, triggering panic promoting by different buyers. This may increasingly improve if promoting stress is excessive downward pressure on prices Bitcoin.

As of this writing, Bitcoin worth is round $64,460, up simply 0.2% prior to now 24 hours.

Bitcoin miners are surrendering

Typical buyers will not be the one gamers contributing to the present promoting stress on Bitcoin’s worth. The most recent on-chain revelations present bitcoin miner It has additionally been energetic in the marketplace in current weeks.

Based on knowledge Enter the neighborhood, Bitcoin miners have dumped greater than 30,000 BTC (price roughly $2 billion since June). That is the quickest price of decline in Bitcoin miner reserves in additional than a yr.

Blockchain evaluation attributes the sell-off to diminished miner profitability following the current halving occasion. this The fourth halving eventIn an occasion that occurred in April 2024, miner rewards dropped from 6.25 BTC to three.125 BTC.

The worth of Bitcoin makes an attempt to cross $65,000 on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView