There’s rising dialogue all through the crypto neighborhood in regards to the following points Forward of Bitcoin’s subsequent cycle, a market skilled gives insights on urgent matters Potential timelines for the biggest digital belongings to expertise value peaks through the present cycle.

Bitcoin’s subsequent cycle high will happen in 2025

Cryptocurrency skilled and dealer Rekt Capital made a daring prediction on the X (previously Twitter) platform: pinpointed The precise timetable for Bitcoin’s subsequent cycle peak reveals that the digital asset could start to rebound considerably within the brief time period.

Citing historic developments and key elements, Rekt Capital believes BTC’s subsequent cycle high might happen subsequent yr market cycleparticularly earlier than and after Bitcoin Halving occasions, proving to be per earlier bull markets.

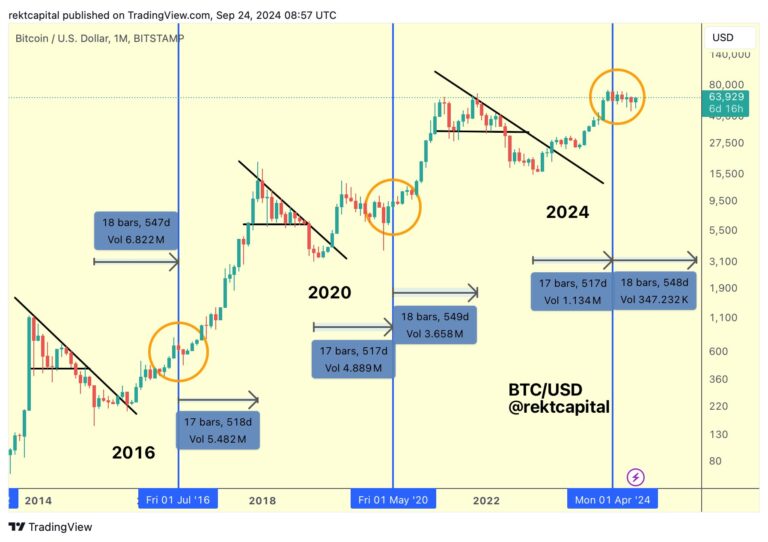

In accordance with market consultants, earlier than the 2016 halving occasion, Bitcoin reached its lowest level 547 days in the past and reached the height of the bull market roughly 518 days later. As well as, the worth Bitcoin The bull market peaked 549 days after the 2020 halving occasion and bottomed roughly 517 days in the past.

On the identical time, Bitcoin costs additionally skilled a 517-day backside earlier than the April 2024 halving. Consequently, Rekt Capital believes that crypto belongings could expertise a peak in a bull run 549 days after the halving, which places the highest of the cycle round October 2025. Given these correction patterns, analysts level out two key takeaways for buyers and merchants on what to anticipate major price changes Within the lead-up to the height of the cycle.

The primary level Rekt Capital emphasizes is that the Bitcoin halving is sort of a mirror. It’s because the variety of days it takes for a Bitcoin bear market backside to happen earlier than the halving is roughly the identical because the variety of days it takes for the crypto asset to type a bull market high after the halving. The second takeaway is that the most effective days of the Bitcoin bull run are but to come back.

BTC is about to enter a parabolic rise section

Notably, Bitcoin’s path to a cycle peak might start quickly as analysts predict an impending shift in market sentiment. After analyzing the present value development of BTC, Rekt Capital famous Historical past means that the asset will transfer from a re-accumulation section right into a parabolic advance over the subsequent week or so.

Up to now, BTC has damaged out of its re-accumulation section between 154 and 161 days after the halving. On condition that within the present cycle, the asset has been on this stage for about 157 days after the occasion, consultants anticipate breakthrough within the coming days.

Featured photographs from Unsplash, charts from Tradingview.com