Analyst agency CryptoQuant’s Bitcoin Cycle Indicator means that Bitcoin has transitioned right into a bearish part following the crash.

CryptoQuant’s Bitcoin Bull-Bear Cycle Indicator is at present in adverse territory

in a brand new postal Concerning X, CryptoQuant Analysis Director Julio Moreno mentioned “Bull and Bear Market Cycle Indicator” Designed by analytics agency.

The indicator relies on CryptoQuant’s Revenue and Loss Index, which itself is the unification of a number of totally different fashionable on-chain indicators associated to unrealized and realized income and losses.

The Revenue and Loss Index is mainly a strategy to decide whether or not BTC is at present in a bear market or a bull market. When this indicator breaks above the 365-day transferring common (MA), BTC may be thought-about to have entered a bullish part. Likewise, a break under the transferring averages alerts a bearish flip.

The Bull and Bear Market Cycle indicator is the precise indicator of curiosity right here, visualizing the P&L index in a extra handy type by monitoring its distance from the 365-day transferring common.

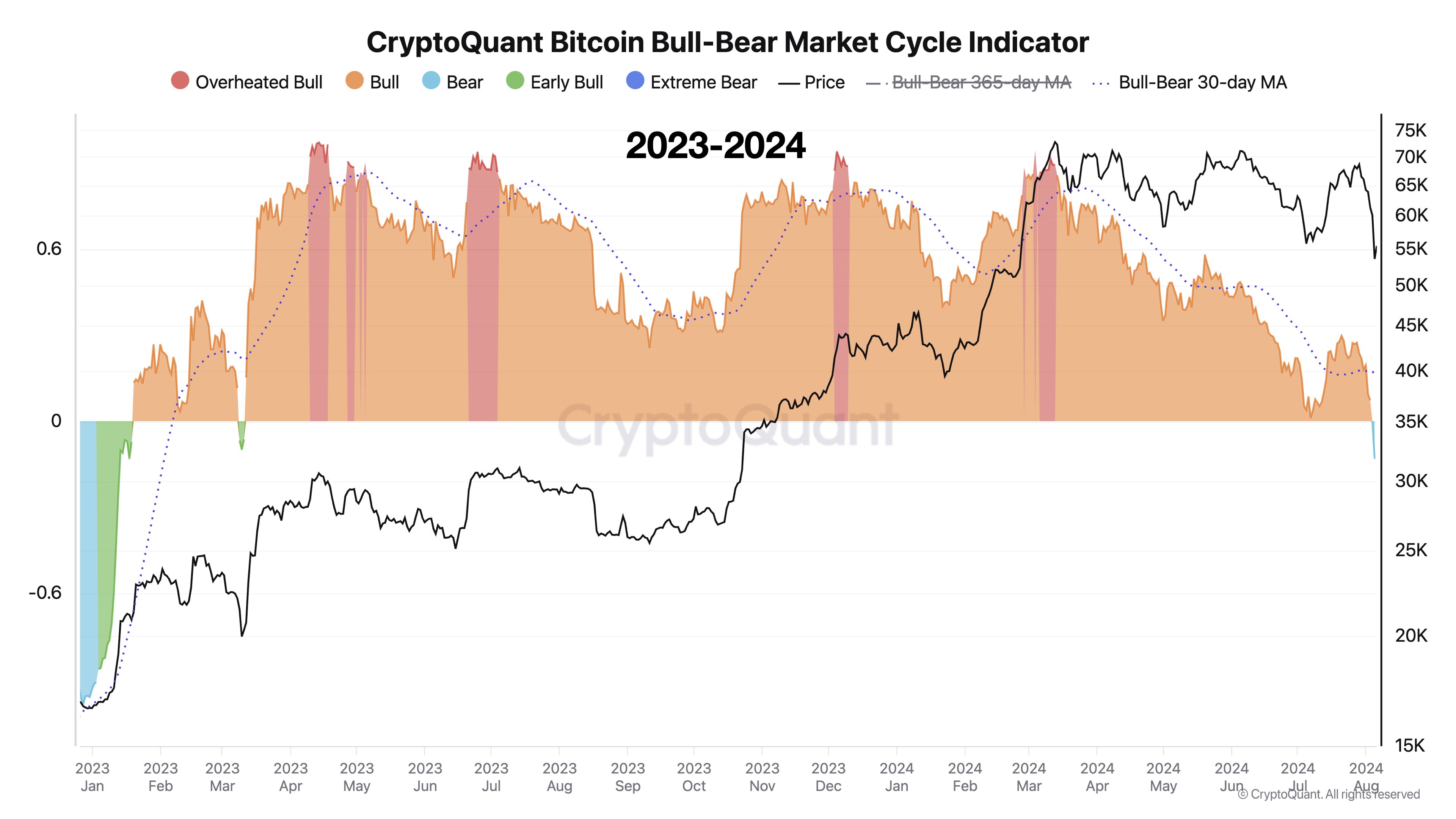

Now, the chart under exhibits the pattern of this Bitcoin indicator over the previous few years:

The worth of the metric seems to have plunged into the adverse territory in latest days | Supply: @jjcmoreno on X

As proven within the chart above, the Bitcoin Bull and Bear Market Cycle indicator spiked earlier this 12 months when the asset’s worth rallied to new ranges. All Time High (ATH) and reached an space generally known as an “overheated bull market.”

At these values, the P&L Index is considerably larger than its 365-day transferring common, so the asset’s worth is taken into account overheated. Along with these overheated values, the asset hit a peak that continues to be the top of the rally to date.

After spending a number of months in regular bull market territory, the indicator seems to have fallen under the zero line, that means that the P&L Index has now fallen under the 365-day transferring common.

The Bull-Bear Market Cycle Indicator now marks Bitcoin’s entry right into a bear market part. Moreno identified that that is the primary time the indicator has issued this sign since January 2023.

Nevertheless, it is very important do not forget that this sign doesn’t essentially imply that cryptocurrencies are getting into a long-term part. bear market. As famous by the pinnacle of CryptoQuant, this indicator has solely quickly marked a bearish part for BTC over the previous time period.

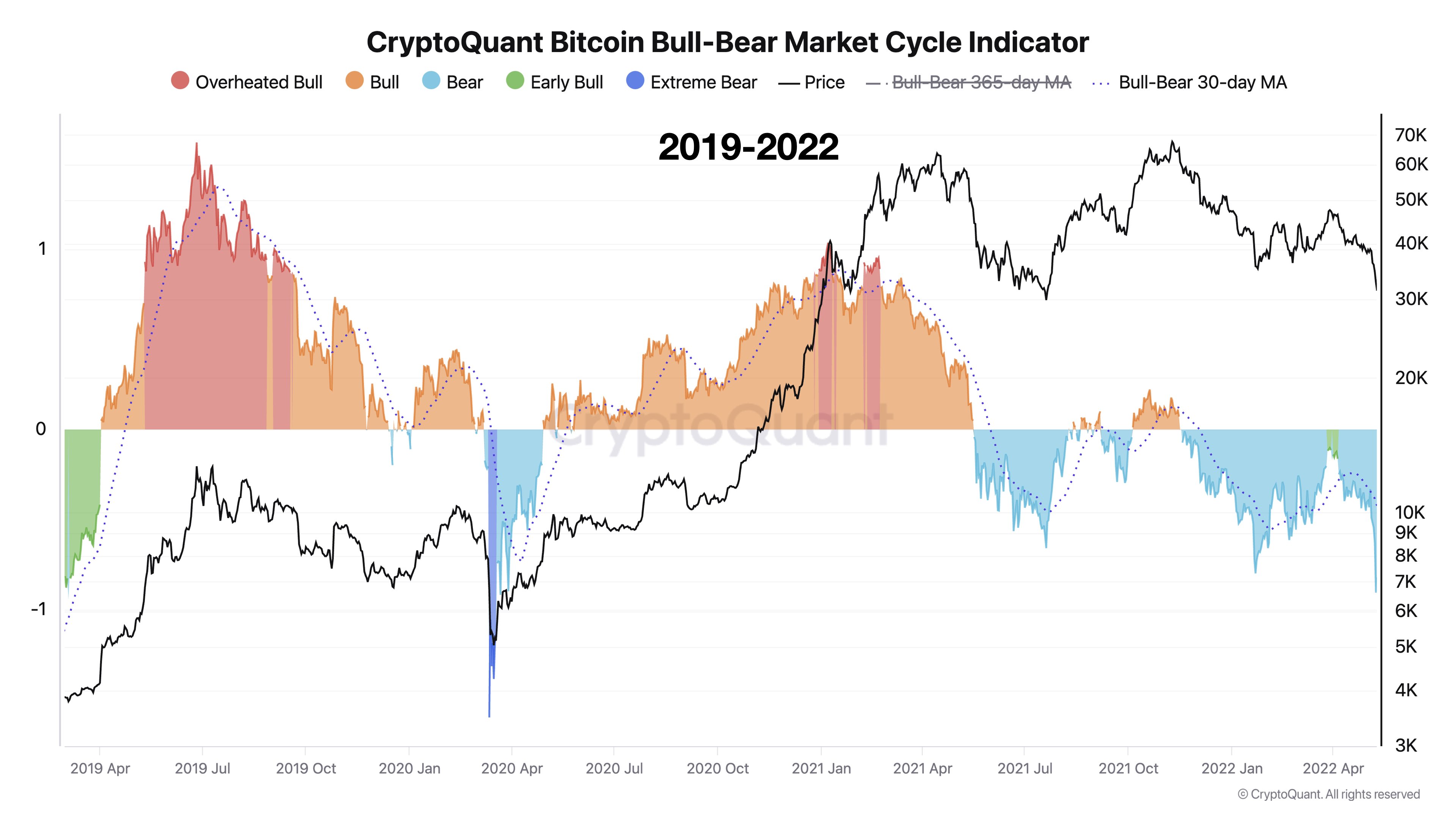

The earlier bear phases for the asset | Supply: @jjcmoreno on X

As is obvious from the chart, each the COVID-19 crash in March 2020 and the Chinese language mining ban in Could 2021 resulted in short-term bearish phases from an indicator perspective.

Now, it stays to be seen whether or not the Bitcoin bull-bear market cycle indicator may even stay in adverse territory anytime quickly.

bitcoin worth

As of this writing, Bitcoin is buying and selling just under $57,000, down practically 14% previously seven days.

Appears like the worth of the coin has been making restoration for the reason that crash | Supply: BTCUSD on TradingView

Featured pictures from Dall-E, CryptoQuant.com, charts from TradingView.com