On-chain knowledge reveals that retail demand for Bitcoin has fallen to a three-year low, an indication that might be bearish for Bitcoin.

Bitcoin retail switch quantity has dropped sharply not too long ago

As CryptoQuant founder and CEO Ki Younger Ju explains in a brand new report postal On X, retail demand has fallen sharply not too long ago. this”retail investorsThis refers back to the smallest buyers within the Bitcoin market.

The switch volumes that correspond to them are sometimes used to trace the demand that exists amongst any group to make use of cryptocurrencies. For retail buyers, their transaction worth is often lower than $10,000 as a consequence of their smaller dimension.

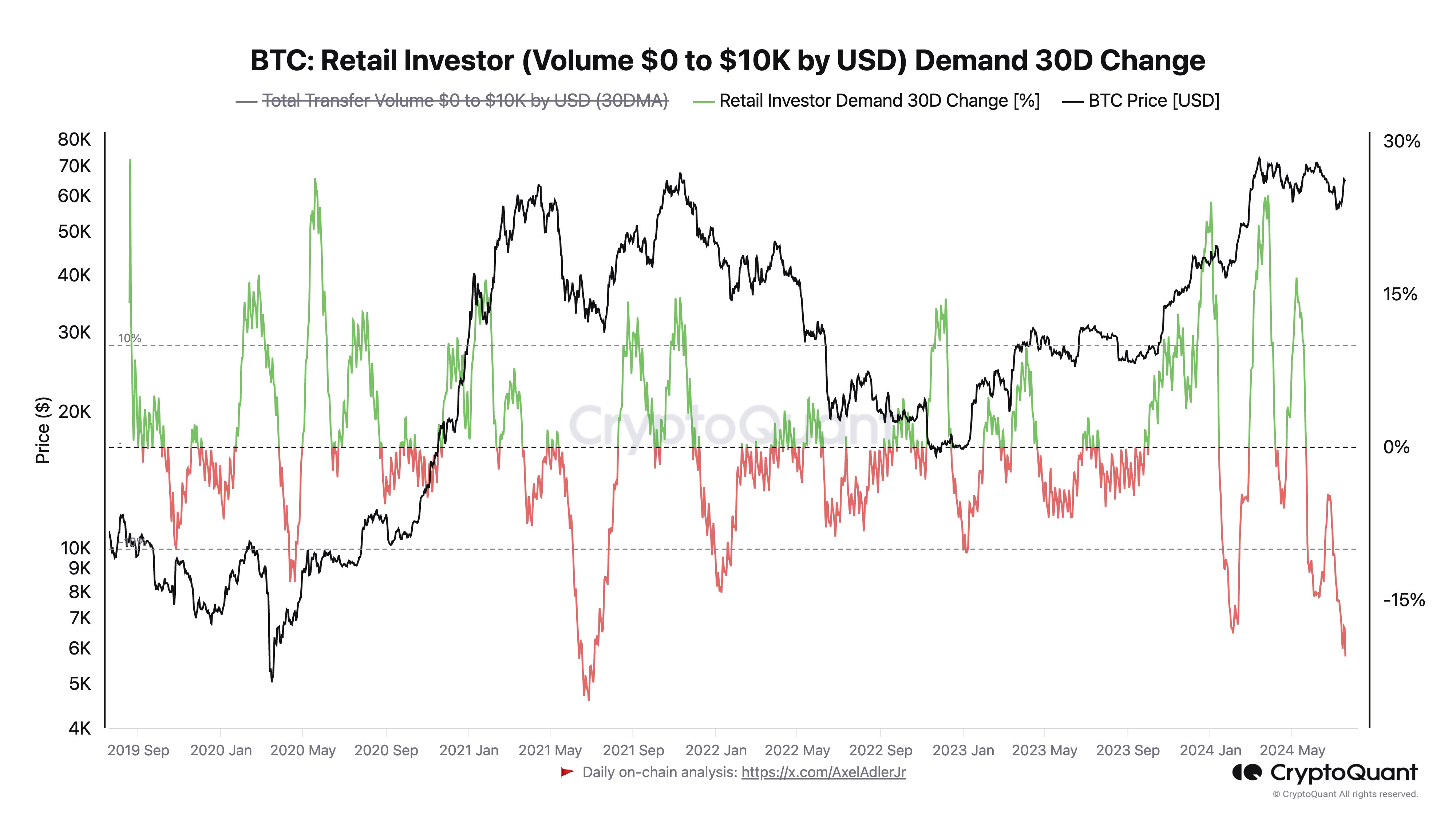

Due to this fact, Younger Ju cited the 30-day change in whole switch quantity for transactions of this dimension to point out the present demand scenario amongst retail buyers.

Beneath is a chart shared by the founding father of CryptoQuant, displaying the development of this indicator over the previous few years.

The worth of the metric appears to have noticed a pointy decline in latest days | Supply: @ki_young_ju on X

As you’ll be able to see from the chart above, the 30-day change in switch volumes from retail buyers has not too long ago fallen into unfavourable territory for Bitcoin, which means switch volumes related to these holders have been shrinking.

The speed of decline is critical as the worth of this indicator is presently at its lowest degree in roughly three years. This retracement means that the latest bearish habits available in the market has prompted retail buyers to lose curiosity in cryptocurrencies.

Bitcoin costs have been recovering over the previous week, however apparently not sufficient to reignite demand from this group. It stays to be seen whether or not switch volumes from these buyers will choose up within the coming days if costs proceed on this trajectory.

Though retail buyers have seen decrease demand for blockchain use not too long ago, they’re nonetheless shopping for into it, as analyst James Van Straten explains in X. postal.

The development within the retail investor demand for purchasing or promoting the asset | Supply: @jvs_btc on X

The analyst additionally famous how these buyers are beginning to act like good cash. The chart reveals that they have been web consumers throughout Bitcoin worth declines whereas promoting close to the highest.

Probably the most outstanding instance of this sample is when this group went on a shopping for spree throughout bear market lows because the inventory market crashed. Cryptocurrency exchange FTX.

bitcoin worth

On the time of writing, Bitcoin is buying and selling round $64,100, up greater than 11% up to now seven days.

Seems like the worth of the asset has been shifting sideways over the previous few days | Supply: BTCUSD on TradingView

Featured pictures are from Dall-E, Glassnode.com, CryptoQuant.com, and charts are from TradingView.com