If Robert Kaplan nonetheless had a say within the matter, he would push for a half-percentage level charge lower at this week’s Fed assembly.

The previous president of the Federal Reserve Financial institution of Dallas advised CNBC on Tuesday, A bolder 50 basis point rate hike will higher place policymakers for financial challenges within the second half of this yr and past.

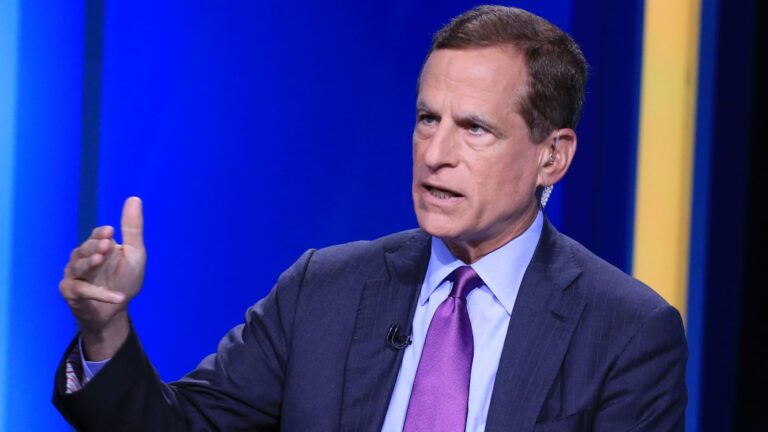

“If I had been sitting on the desk, I might advocate for 50 individuals on this assembly,” Kaplan stated.scream box“Interview. “I believe the Fed will most likely meet a bit later, and if I had it to do over once more, I might most likely favor that we begin chopping charges in July relatively than September.

The market at the moment sees a roughly 2-to-1 likelihood of the FOMC approving a 50 foundation level charge lower, relatively than Cut interest rates by 25 basis points As of Friday, the value had been pricing in Fed Watch. 1 foundation level equals 0.01%.

Federal funds, the central financial institution’s benchmark in a single day lending charge, at the moment ranges from 5.25% to five.50%.

Kaplan stated he would chair the committee if it determined to take extra drastic steps Jerome Powell Additional cuts sooner or later “will doubtless be extra cautious,” he stated at a post-meeting press convention on Wednesday. The Federal Reserve’s two-day coverage assembly begins on Tuesday.

“From a threat administration perspective, 50 makes probably the most sense,” Kaplan stated. “If there is a break up within the group, actually, quite a bit will rely on what Jay Powell thinks personally, what his private choice is on all this, and his capacity to persuade everybody to come back to a unanimous choice.”

Kaplan served as chairman of the Federal Reserve Financial institution of Dallas from 2015-21 and is at the moment a managing director at Goldman Sachs.