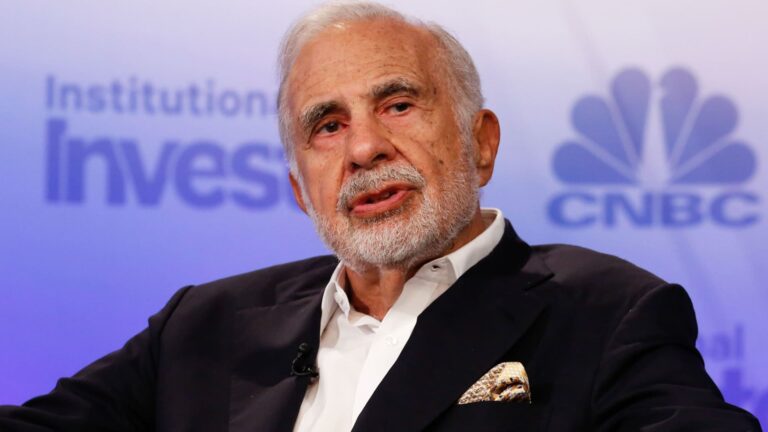

Carl Icahn speaks on the Delivering Alpha convention in New York on September 13, 2016.

David A. Grogan | David A. Grogan CNBC

Carl Icahn’s funding firm Icahn Enterprises has gained the dismissal of a lawsuit that claimed it artificially inflated its inventory worth by issuing unsustainably excessive dividends to assist the CEO. Billionaire buyers take out large private loans.

In a ruling on Friday, U.S. District Choose Ok. Michael Moore in Miami mentioned shareholders within the proposed class motion had didn’t show that the corporate made a cloth misrepresentation or omission and that in doing so The aim is to defraud.

Legal professionals for the shareholders didn’t instantly reply to requests for remark. An Icahn Enterprises spokesman didn’t instantly reply to the same request. Moore gave shareholders till Oct. 14 to submit an amended criticism.

Icahn Enterprises shares have fallen by greater than three-quarters since Might 2023, when short-selling agency Hindenburg Analysis raised questions on its dividends and Icahn’s borrowings and accused him of overseeing a “Ponzi-like financial construction.” ”.

Final month, with out admitting wrongdoing, Icahn agreed to pay $2 million to settle U.S. Securities and Trade Fee civil costs that he didn’t disclose massive borrowings backed by inventory.

Shareholders say the true well being of Icahn’s enterprise grew to become obvious because the auto elements enterprise went bankrupt, the corporate slashed its dividend and Icahn renegotiated loans.

Icahn, who owns about 85% of the corporate, personally misplaced billions of {dollars} because the inventory worth fell.

In his 28-page resolution, Moore cited the corporate’s disclosure of a possible dividend minimize and mentioned its basic disclosures about Carl Icahn’s borrowings have been enough to alert buyers to the dangers.

He additionally mentioned that Icahn Enterprises’ 2021 annual report disclosed Carl Icahn’s inventory pledge and didn’t accuse any defendant of insider buying and selling.

“This conduct demonstrates that particular person defendants, together with Icahn, imagine within the long-term worth of the IEP and is inconsistent with the speculation that the defendants engaged in a scheme to artificially inflate the inventory worth for private acquire,” Moore wrote.

The case is Kosowsky v. Icahn Enterprises LP et al., U.S. District Court docket for the Southern District of Florida, No. 23-21773.