Intel CEO Patrick Gelsinger speaks on the Intel Ocotillo campus in Chandler, Arizona, on March 20, 2024.

Brendan Smirovsky | AFP | Getty Pictures

It has been fairly every week Intel.

The chipmaker has misplaced greater than half its worth this 12 months and final month worst day After a disappointing earnings report, Monday kicked off a 50-year run available in the market. declare The corporate is separating its manufacturing arm from its core enterprise of designing and promoting pc processors.

On Friday evening, CNBC confirmed Qualcomm have Recently contacted Intel’s acquisition can be one of many largest know-how offers ever. It is unclear whether or not Intel has been in talks with Qualcomm, and representatives from each firms declined to remark. The Wall Avenue Journal first reported the story.

The inventory gained 11% this week, its finest efficiency since November.

The rally has come as no reduction to Chief Govt Pat Gelsinger, who has struggled since taking the helm in 2021. chip producer and suffered a heavy setback within the discipline of synthetic intelligence chips. NVIDIApresently valued at practically $3 trillion, is greater than 30 instances Intel’s market worth of simply over $90 billion. Intel stated in August that it could reduce 15,000 jobs, accounting for greater than 15% of its workforce.

However Gelsinger remains to be calling the pictures, saying Intel is shifting ahead as an unbiased firm and has no plans to spin off foundries. in a memorandum He advised staff on Monday that whereas the corporate was making a separate inside unit for the foundry, with its personal board and governance construction and the potential to boost exterior capital, the 2 components “can be higher collectively.”

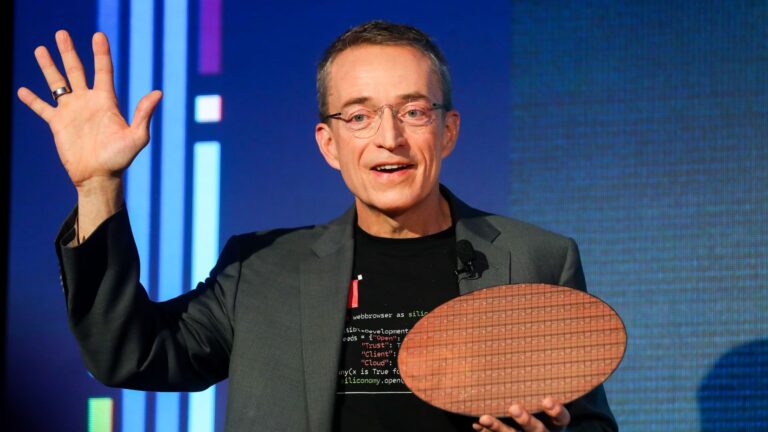

Intel CEO Pat Gelsinger speaks throughout an indication of silicon wafers at an occasion referred to as “AI In all places” in New York on Thursday, December 14, 2023.

Seth Little | Related Press

The highway to restoration is not getting any smoother for the corporate that makes chips in Silicon Valley. By shifting ahead as an organization, Intel should concurrently clear two large obstacles: Over $100 billion Construct chip factories in 4 totally different states by 2029 whereas gaining a foothold within the synthetic intelligence increase that may outline the way forward for know-how.

Intel expects to spend about $25 billion this 12 months and $21.5 billion subsequent 12 months on its foundries, hoping that turning into a home producer will persuade U.S. chipmakers to maneuver their manufacturing house moderately than counting on Taiwan Semiconductor Manufacturing Co (TSMC) and Samsung.

That prospect can be extra palatable to Wall Avenue if Intel’s core enterprise is in a number one place. Though Intel nonetheless makes many of the processors that energy PCs, laptops and servers, it’s shedding market share to rivals. AMD and reported income declines threatening its money circulation.

“The subsequent stage of the casting journey”

As challenges mounted, the board met final weekend to debate the corporate’s technique.

The brand new governance construction for the foundry enterprise introduced on Monday is a gap salvo to reassure buyers that main modifications are underway as the corporate prepares to launch a producing course of referred to as 18A subsequent 12 months. Intel says it has seven merchandise in growth and has already gained a serious buyer, asserting Amazon It should use its foundries to supply community chips.

“We’re getting into the following section of our foundry journey, which is essential,” Gelsinger advised CNBC’s Jon Fortt. “As we transfer into the following section, it is extra about being extra environment friendly and Making certain we ship good shareholder returns on these important investments.”

Nonetheless, it is going to take years for Gelsinger’s foundry guess to repay. Intel stated within the memo that it doesn’t anticipate significant gross sales from exterior prospects till 2027. Malaysian manufacturing unit.

British Semiconductor It’s a big within the chip manufacturing trade, manufacturing for firms akin to Nvidia, Apple and Qualcomm. Its know-how allows fabless firms (people who outsource manufacturing) to make chips which might be extra highly effective and extra environment friendly than what Intel’s factories can presently churn out. Even a few of Intel’s high-end PC processors use TSMC.

Intel has but to announce key conventional U.S. semiconductor prospects for its foundries, however Gelsinger stated to remain tuned.

“Due to the fierce competitors, some prospects do not wish to give their names,” Kissinger advised Ford. “However we have seen a big enhance within the quantity of buyer pathway exercise we’re doing.”

Earlier than Amazon’s announcement, Microsoft explain Earlier this 12 months, it introduced it could use Intel foundries to supply customized chips for its cloud companies, a deal that might be price $15 billion to Intel. Microsoft CEO Satya Nadella In February it stated it could use Intel to supply its chips, however didn’t present particulars. Intel additionally signed a contract with MediaTek, which primarily produces low-end chips for cell phones.

On September 9, 2022, U.S. President Biden listened to Intel CEO Pat Kissinger’s speech whereas attending the groundbreaking ceremony of Intel’s new semiconductor manufacturing plant in New Albany, Ohio, the USA.

Joshua Roberts | Reuters

get authorities assist

Intel’s largest backer is presently the U.S. authorities, which is working to safe U.S. chip provides and restrict the nation’s dependence on Taiwan.

Intel stated this week it acquired $3 billion to make chips for navy and intelligence businesses in a specialised facility referred to as a “safe enclave.” The plan is confidential, so Intel has not revealed particular particulars. Kissinger additionally just lately met with Secretary of Commerce Gina RaimondoIntel’s future function in chip manufacturing is being loudly touted.

Earlier this 12 months, Intel Grant The Biden administration will present as much as $8.5 billion in CHIPS Act funding and can have entry to a further $11 billion in loans from the invoice, which is handed in 2022.

“In the end, I feel what policymakers need is for the U.S. semiconductor trade to thrive,” stated Anthony Rapa, a companion at Clean Rome, a legislation agency that focuses on worldwide commerce.

Presently, Intel’s largest foundry buyer is itself. The corporate started reporting the unit’s financials this 12 months. In its newest quarter, which led to June, the corporate had an working lack of $2.8 billion on income of $4.3 billion. Solely $77 million of income got here from exterior prospects.

Intel’s purpose is to attain $15 billion in exterior foundry income by 2030.

Whereas this week’s announcement is considered by some analysts as a primary step towards a sale or spinoff, Gelsinger stated the transfer is designed partly to assist win over new prospects who could also be involved about their mental property leaking from foundries to Intel’s different companies.

“Intel believes this may present a clearer distinction between exterior foundry prospects/suppliers,” JPMorgan analysts wrote in a be aware. JPMorgan analysts have a promote ranking on the inventory. “We consider this might finally result in a spin-off of the enterprise within the coming years.”

No matter occurs there, Intel must discover a answer for its fundamental enterprise of core PC chips and Xeon server chips.

Intel’s consumer computing unit, the PC Chip Division, reported that its income was down about 25% from its peak in 2020 in contrast with final 12 months. The info heart section declined 40% throughout this era. In 2023, server chip manufacturing will lower by 37%, and the price of producing server merchandise will enhance.

Intel has added bits of synthetic intelligence to its processors as a part of a drive to spice up gross sales of latest PCs. However it nonetheless lacks a powerful AI chip competitor that may compete with Nvidia’s GPUs, which dominate the info heart market. Futurum Group’s Daniel Newman estimates that Intel’s Gaudi 3 AI accelerator solely contributed about $500 million in gross sales to the corporate final 12 months, in contrast with Nvidia’s $47.5 billion in knowledge heart gross sales in its newest fiscal 12 months.

Newman is asking the identical query as many Intel buyers about the place the corporate will go from right here.

“Should you separate these two issues, you assume, ‘Nicely, what are they finest at? Have they got one of the best course of? Have they got one of the best design?'” he stated. “I feel a part of what makes them sturdy is that they’ve finished all of it.”

—CNBC’s Rohan Goswami contributed to this report