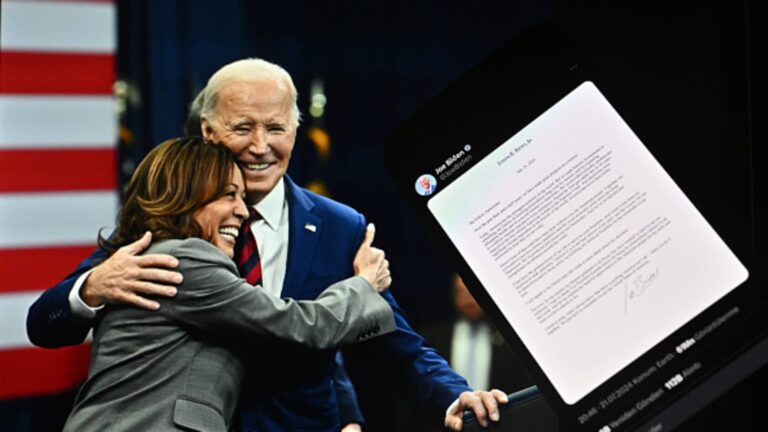

On July 21, 2024, in Ankara, Turkey, a cell phone display in entrance of a pc display confirmed the letter from US President Joe Biden asserting his withdrawal from the marketing campaign. The pc display confirmed President Biden and US Vice President Kamala Harris. photograph.

Anadolu | Anadolu | Getty Photographs

this “Trump Trade” Trump’s feedback could also be tempered after President Joe Biden dropped out of the 2024 presidential race in favor of Vice President Kamala Harris.

Biden’s debate performance was shocking and Assassination attempt on former President Donald Trump Stimulus markets are pricing in one other time period for a Republican challenger.

Trump trades seek advice from shares anticipated to profit if the previous president returns to the White Home.

CNBC beforehand reported that Wall Road believes A Trump win would be good for stocks Simply as Republican candidates are calling for decrease taxes and deregulation. As an alternative, merchants predict inexperienced power shares can be hit by Trump’s proposed tariff hikes, which some economists say might result in increased inflation.

Asian markets mostly lower On Monday morning, it was the primary area to renew regular buying and selling following Biden’s announcement.

Michael Brown, senior analysis strategist at Australian brokerage Pepperstone, instructed CNBC that an exit was largely anticipated given the Democrats’ mounting stress and “disastrous debate efficiency.”

Brown mentioned he expects volatility throughout asset lessons given the uncertainty that has been injected into the election and the race for the White Home is now extra open. The strategist predicts the greenback will weaken as a number of the “Trump commerce” unwinds, including that he sees a slight enhance in prospects for a Democratic victory.

He additionally anticipated shares to fall within the brief time period, however famous that any decline must be considered as a medium-term shopping for alternative as a result of the Fed remains to be anticipated to chop rates of interest and financial and revenue development stay resilient. The U.S. is because of launch second-quarter private consumption expenditures knowledge – the Fed’s most well-liked inflation gauge – on Thursday.

David Roche, president of Quantum Methods, mentioned in a observe earlier Monday that Harris is more likely to obtain Democratic assist, noting that “altering Harris at this level would result in better confusion and can elevate many questions on obtainable funding” for the Biden-Harris joint vote. “

Roach, nonetheless, mentioned Harris’ nomination will increase Trump’s possibilities of profitable however lowers the possibilities of Republicans profitable each homes of Congress.

an entire new recreation

In distinction, Charles Myers, founder and CEO of consulting agency Signum International Coverage, took a special stance on Harris’ potential nomination.

In an interview with CNBC “Squawk Box Asia,” Myers mentioned, Harris’ emergence because the front-runner for the Democratic nomination makes it “an entire new race.”

“There is a new candidate who has great unity and enthusiasm behind her. She’s going to be a key mover for girls, younger folks, black voters… I believe folks will underestimate her,” he added.

Harris has already made historical past as the primary girl and first black individual to function vice chairman. If she wins the Democratic nomination, she’s going to grow to be the second girl to run for president, following Hillary Clinton in 2016.

“I believe it is too early for the market to declare Trump the winner, and I believe she’s going to have an actual competitors with him,” Myers mentioned.

Like Pepperstone’s Brown, Myers added that the “Trump deal” is dangerous, a minimum of within the brief time period.

Myers mentioned Harris could have a working mate chosen by the point the Democratic Nationwide Conference begins on Aug. 19 and predicted she’s going to “win the nomination with great momentum,” placing the vice chairman forward within the polls. Trump.

“That is a fairly good efficiency throughout a number of names and different asset lessons tied to a Trump win, nevertheless it’s additionally sitting too far again and a marketing campaign that simply fell into full disarray… I’d assume Trump is about to win, and we will be very cautious, a bit of cautious.