final yr i wrote about In 2005, the Supreme Court docket Kelo v. City of New Londona controversial 5-4 resolution by which the justices dominated that condemning housing for personal “financial improvement” was permissible beneath the Fifth Modification’s Takings Clause, which solely permits taking for “public functions.” In January 2023, Renaissance City Growth Affiliation (a personal non-profit improvement firm Formerly known as New London Development Corporationwhich took possession after the property was expropriated) bought the condemned land to a developer who was planning to construct new housing on it. Up to now, the one common person of the deserted land because the final householders had been compelled out is a wild cat colony. The purportedly well-planned improvement that justified the condemnation finally failed, as did among the later proposed land makes use of.

new london sky, recent reports The event is ongoing, however the metropolis has given the developer a large $6.5 million in tax breaks to get it going:

Metropolis Council Monday evening [Sept. 16] Accredited to supply almost $6.5 million in tax breaks over 20 years to a developer planning to construct 500 new residences in two areas on the Fort Trumbull peninsula which were vacant for greater than 20 years.

mounted tax agreement The partnership with RJ Growth + Advisors, LLC, accepted by a 5-2 vote, will offset half of roughly $13 million in pre-construction prices to satisfy floodplain necessities and handle remaining repairs and different subsurface points at each websites.

In trade, the town will obtain about $18 million in tax income over the 20-year interval of the settlement, and Mayor Michael Passero famous that the parcels have sat idle with out paying taxes in a technology.

The vote adopted heated exchanges and rousing remarks amongst council members, calling the peninsula’s darkish previous emblematic of the nation’s eminent area.

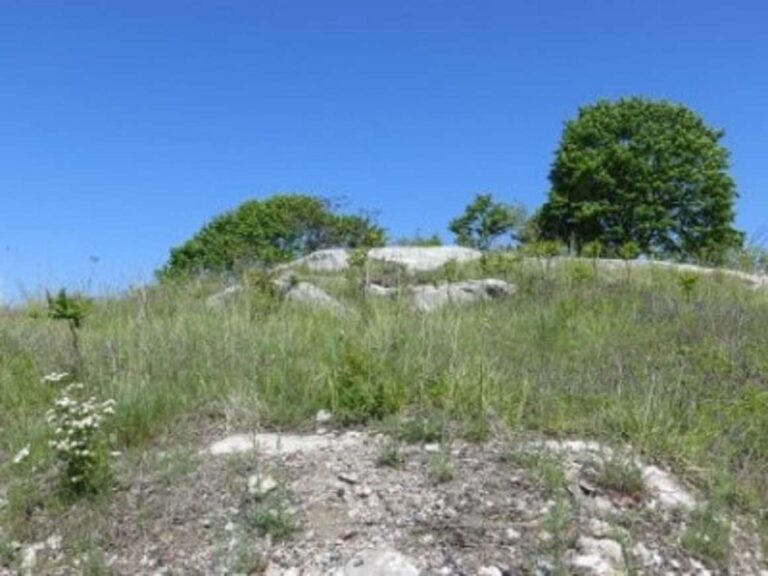

Huge tracts of land within the Fort Trumbull space stay undeveloped after a controversial demolition and improvement marketing campaign by the previous New London Growth Company. Kelo v. New London.

Calling the choice a failure that left an “open sore” on the land, Passero mentioned the housing scheme can be a balm “to assist heal the wound.”

Councilmembers Jeffery Hart and John Satti, who each voted towards the tax deal, echoed issues raised by a number of residents earlier within the assembly, together with the prospect of sweetheart offers being supplied to builders, The developer expects to make hundreds of thousands of taxpayer {dollars} from a sponsored challenge.

“It is vital to indicate resistance to people who find themselves providing you a foul deal,” Hart mentioned. “There’s a whole lot of assumption that no different developer will tackle the challenge (with out tax breaks).”

However Felix Reyes, the town’s director of planning and financial improvement, mentioned no different viable buyers have come ahead because the property went available on the market. Reyes acknowledged the trauma skilled by former residents of the peninsula and the “cruelty” dedicated as a part of the town’s efforts to draw personal improvement.

“There isn’t any line out the door for builders keen to take part on this challenge,” Reyes mentioned, including that any such firm would face the identical pre-construction prices as RJ Growth, together with the price of constructing the complicated on an elevated platform. Require.

Like most actual property students and land use economists, I’m skeptical of the worth of focused tax breaks and subsidies like this one. A greater approach to promote improvement is to create an excellent enterprise setting throughout the board and respect property rights. Moreover, projections of the advantages of such taxes and subsidies are sometimes exaggerated. I doubt the Metropolis will really get the $18 million in tax income it was promised.

After all, the anticipated advantages of “financial improvement” are like cellar It’s also typically exaggerated. There are few higher examples than cellar Condemn your self. Even when this new improvement is totally profitable, it doesn’t show that the unique improvement was appropriate cellar earnings. as i defined my previous post Relating to this subject:

Since 2005, a number of makes an attempt to redevelop the deserted land have failed. Hope it really works this time. However even when it did, I do not assume it will in some way show cellar condemn. The brand new improvement plan is markedly totally different from the critically misguided plan that led to the usage of eminent area greater than 20 years in the past. Moreover, by the point any development is accomplished, the land may have been idle for nearly twenty years (apart from the feral cats!). From a improvement perspective, this can be a large waste.

The realm would virtually definitely be in higher financial form if the unique house owners had been allowed to proceed residing there, paying property taxes and contributing to the native economic system. That doesn’t even keep in mind the immense ache and struggling the unique improvement triggered to those that misplaced their houses (together with some who “voluntarily” bought their houses as a consequence of harassment and threats of eminent area).

I’d add that if the town merely left the property house owners alone, they would not have to supply focused tax breaks for anybody to develop the land.

Except you are one of many feral cats that dwell on the land, it is arduous to justify this conduct cellar earnings!

I’m going into nice depth in regards to the historical past of the condemnation course of and the hurt it causes in The Condemnation Course of . Grasping hand: Kelo v. City of New London and limitations on eminent domain.my e-book about cellar The case and its penalties. In that e-book, I additionally defined why the Supreme Court docket’s resolution was fallacious from the angle of originalism and residing constitutionalism.