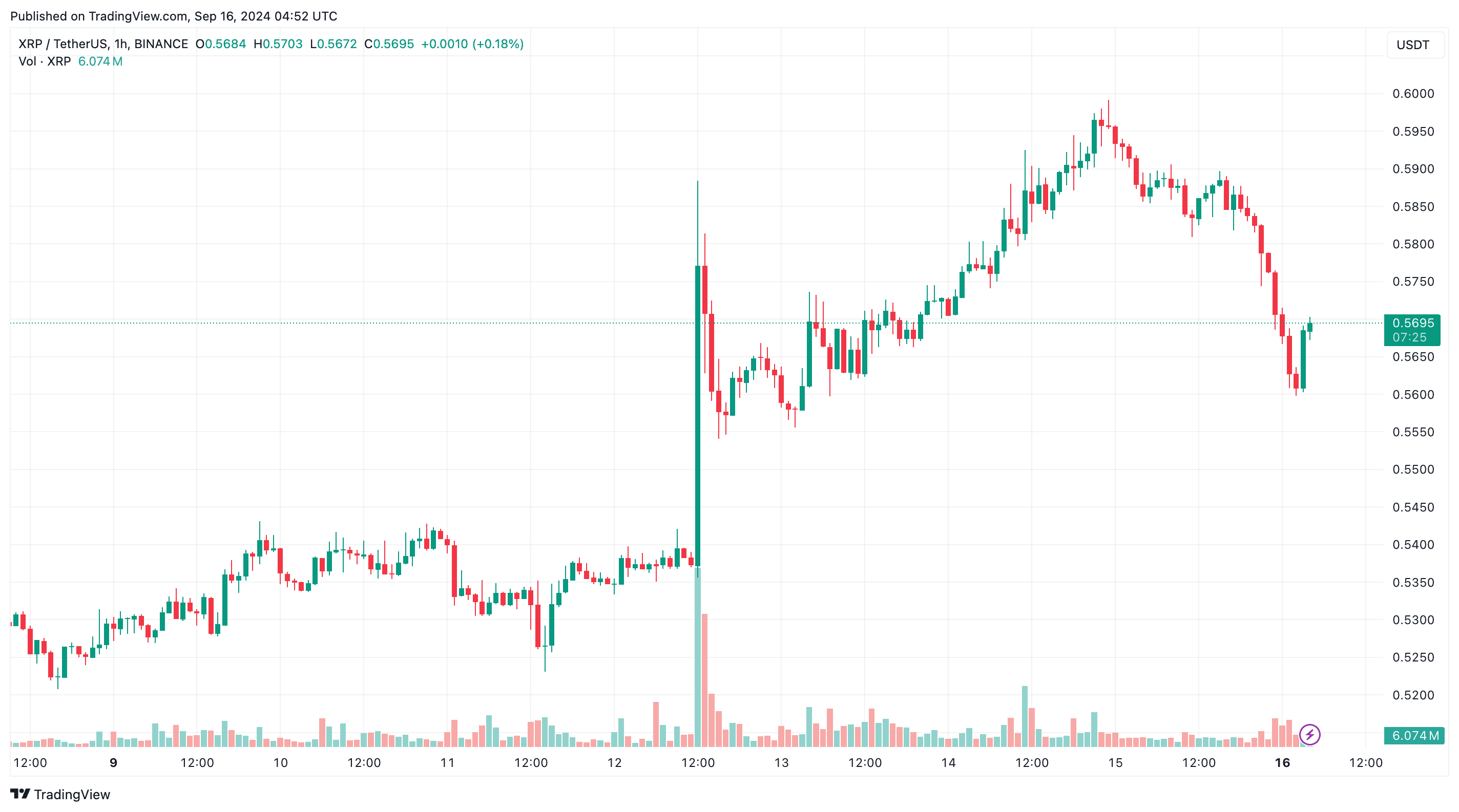

The worth of XRP has retraced a couple of proportion factors of its weekly features however remains to be up 7.2% over seven days after a robust second half of the week.

The RippleNet token, which has a complete market capitalization of over $30 billion this weekend, took the lead on cryptocurrency exchanges final Thursday, with costs surging to over $0.57 per token.

But it surely wasn’t till the subsequent day that Bitcoin, Ethereum and different high cryptocurrencies mirrored related wealth features on the general public markets. The information of Grayscale launching a brand new XRP belief product shocked the Ripple market.

So, is there extra left on this Ripple rally, or will this wave unfold to different altcoins in September?

Listed below are three bullish and two bearish indicators for XRP in September.

1. Grayscale’s XRP Belief

Grayscale is a Park Avenue crypto asset administration firm specializing in personal fairness investments for prime internet price people (HNWI). declare On Thursday, it provided “traders entry to XRP” within the first U.S. XRP belief providing.

Rayhaneh Sharif-Askary, head of product and analysis at Grayscale, stated: “We imagine the Grayscale XRP Belief can present traders with entry to a protocol with necessary real-world use circumstances.”

“XRP has the potential to remodel conventional monetary infrastructure by facilitating cross-border funds that take simply seconds,” Sharif-Askary stated.

This information has excited the XRP military on social media, who imagine that that is one other step nearer to the XRP ETF in the US. Grayscale sued the SEC and received, taking part in a key function in bringing the primary Bitcoin ETFs to market.

The distinction between an ETF and a belief is the variety of shares issued by the ETF can change to satisfy demand. Moreover, ETFs commerce all through the day. The belief owns a hard and fast variety of shares that commerce as soon as a day on the shut of the market.

One other entry level for Wall Avenue traders to take part within the Ripple financial system may be very bullish information for the worth of XRP.

2. XRP Fantastic Expertise

In the meantime, XRP worth on cryptocurrency charts is displaying some good technical alerts to Ripple bulls.

TradingView charges XRP a Sturdy Purchase based mostly on easy (SMA) and exponential (EMA) shifting averages on 10-day, 20-day, 30-day, 50-day, 100-day, and 200-day spans.

Moreover, Ripple’s Transferring Common Convergence Divergence Indicator (MACD) formed a A bullish crossover for cross-border fee tokens on Friday.

Due to this fact, a break above the important thing resistance stage of $0.60 may set off a Ripple bull run to $0.68, in line with XRP charting know-how.

3. Robinhood plans to checklist XRP within the EU

One other significantly bullish signal for XRP costs this month: Widespread smartphone buying and selling app Robinhood seems poised to checklist XRP for buying and selling for its EU clients.

The corporate has but to make an official announcement on Sunday, however European customers Found on Saturday They’ll deposit and withdraw XRP worth tracker on the zero-commission buying and selling platform.

Robinhood affords a wide range of cryptocurrencies, together with BTC, ETH, DOGE, SHIB, AVAX, and extra. Final June, Robinhood delisted Cardano (ADA), Polygon (MATIC) and Solana (SOL) after receiving the SEC’s Wells discover.

XRP’s presence on buying and selling apps bodes properly for the token’s vibrant future given regulatory readability because the mud settles on a years-long lawsuit with U.S. regulators.

4. Fmr XRP Bull Raoul Pal Flip

The XRP military is awash with curiosity within the Ripple community because the SEC case unfolds, however not all investor analysts imagine it’s the only option for right this moment’s cryptocurrency traders.

Raoul Pal of Actual Imaginative and prescient Group was a former senior govt at Goldman Sachs and now leads cryptocurrency traders on social media. He was as soon as an enormous bull of Ripple. However now he says that’s not one of the best place for laptop computer capitalists to park their cash on the blockchain.

It is a turning level for Pal, who stated as not too long ago as December 2023 that he Zigzag Ripple When he first bought the tokens in December 2020, he considered it as a “once-in-a-lifetime alternative.” It’s time to take a position your capital in cryptocurrencies with actual use circumstances.”

However in August this yr, Pal stated to not purchase outdated tokens corresponding to XRP and Cardano. He made the remarks in an interview revealed by Good Morning Crypto to X.

He clearly has excessive confidence within the new altcoin, as he warned that Ripple’s supporters are inviting crypto newbies to affix the “cult” of “unrelated currencies.”

“Our job is to be mercenaries. We do it to earn cash,” Pal stated. “Cardano, XRP — there’s an entire bunch of them. I actually hope you’re proper, however hope shouldn’t be an funding technique.

5. Competitors from different altcoins

Following Friday’s rally within the Bitcoin market, a number of of XRP’s primary opponents have seen greater features this week, together with: BNB, DOGE, TON, NEAR, ICP, TAO, and Nervos Community.

The worth of XRP is up round 10% this week (after falling on Monday), whereas TON and ICP are up greater than 13%. The market caps of SUI and AAVE are up 15% from every week in the past. One other Layer-1 chain Bittensor (TAO) rose almost 30% in market buying and selling.

In the meantime, Nervos Community (CKB) has a 7-day acquire of 100%. Intense competitors from different underlying chains in Web3 implies that Ripple must work laborious to take care of and broaden its market capitalization.

publish Ripple September Price Outlook: Is XRP an Altcoin to Watch? first appeared in crypto potato.