The U.S. Securities and Trade Fee (SEC) has dealt a significant setback to the whole crypto business rejected Cboe International Markets filed filings for the Solana ETF from a number of corporations.

In accordance with studies, the SEC’s choice was motivated by issues about Solana’s regulatory standing. Sol Needs to be labeled as “securities”.

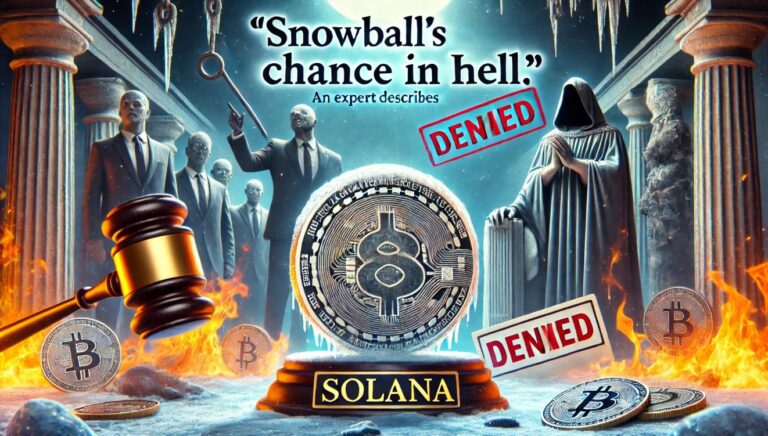

Solana ETF proposal deemed ‘useless on arrival’

according to Bloomberg ETF skilled Eric Balchunas stated the Solana ETF submitting “by no means made it previous step two” within the SEC evaluation course of, referring to the stage the place the regulator publishes a 19b-4 submitting on its web site.

Balchunas stated the shortage of regulatory approval means the Solana ETF proposal has successfully been deemed “DOA,” or “useless on arrival.” Specialists assert that until there’s a vital change within the council’s management, infill’s “possibilities of approval are actually snowballing”.

The SEC’s issues about Solana’s standing as a safety seem to have been communicated on to potential ETF issuers, main Cboe to withdraw its assertion Form 19b-4 on its web site earlier this month.

James Seyffart, a colleague of Balchunas and an ETF skilled, famous The SEC is “actively pursuing this argument in courtroom and elsewhere relating to the classification of sure cryptocurrencies,” suggesting there’s a distinction between classifying SOL as a safety and classifying Ethereum (ETH) as a non-security.

Nevertheless, the story does not finish there. Though Cboe’s submitting has been withdrawn, the S-1 registration assertion for VanEck’s Solana ETF stays lively on the SEC’s EDGAR system.

VanEck makes an attempt to categorise SOL as a commodity

Matthew Sigel, head of digital asset analysis at VanEck, point out The corporate believes that SOL ought to be thought-about a commodity, identical to Bitcoin (BTC) and Ethereum, based mostly on the cryptocurrency’s progress in decentralization.

Sigel pointed to a number of elements supporting Solana’s commodity-like standing, together with a major discount within the focus of SOL holdings among the many prime 100 addresses and the continued progress of the community validator Unfold throughout 41 nations and greater than 300 knowledge facilities.

Moreover, Siegel highlighted the upcoming Firedancer consumer developed by the embattled Solana blockchain jumping cryptocurrencieswhich is anticipated to additional strengthen Solana’s decentralization, making it tougher for any single entity to dominate the blockchain. Siegel concluded:

This decentralized infrastructure mixed with SOL’s practicality and financial function makes it intently built-in with digital commodities similar to BTC and ETH. We stay dedicated to working with our alternate companions to advertise this place to the suitable regulatory authorities.

To make certain, the talk over Solana’s regulatory classification highlights the continued hurdles the fee has confronted over the previous few years because the business seeks higher company adoption and approval Cryptocurrency-based investment products Past the 2 largest cryptocurrencies in the marketplace.

The trail ahead for the Solana ETF stays unsure because the SEC takes a agency stance on the problem. Nevertheless, VanEck seems decided to proceed to advertise its stance on the commodity-like nature of cryptocurrencies.

As of this writing, SOL is buying and selling at $142, a slight change from Monday’s opening value.

Featured photos from DALL-E, charts from TradingView.com