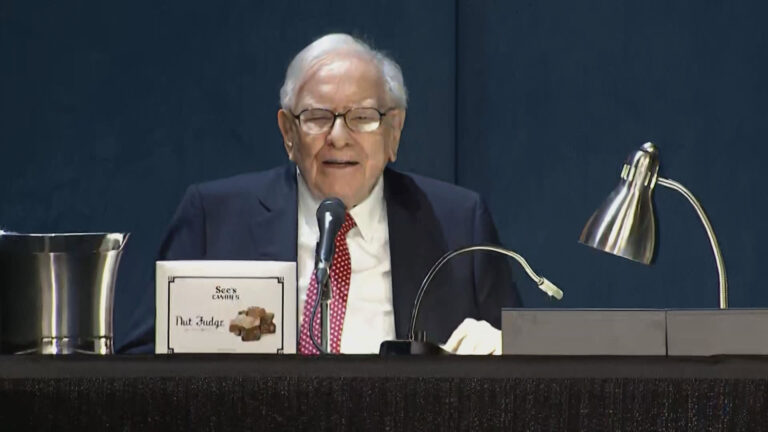

Warren Buffett speaks at Berkshire Hathaway’s annual shareholder assembly on Could 4, 2024 in Omaha, Nebraska.

CNBC

(This text is from the Warren Buffett Watch publication. Register here.)

This summer time, Warren Buffett added about $6 billion to Berkshire Hathaway’s large money pile by means of a collection of measures. Bank of America Stock gross sales start in mid-July.

based on a New submissions on FridayA complete of 21.1 million shares have been bought on Wednesday, Thursday and Friday, producing $848.2 million in income at a median value of $40.24.

Berkshire Financial institution of America shares have been bought for six consecutive buying and selling days. Because the discount started on July 17, the inventory has been lowered in 21 of the previous 33 buying and selling days.

In complete, Berkshire lowered its holdings in Financial institution of America by 14.5%, promoting 150.1 million shares for $6.2 billion. Common earnings per share have been $41.33.

Financial institution of America is Berkshire’s third largest holdingaccounting for about 11% of its portfolio.

Berkshire nonetheless exists Bank of America’s largest shareholder Holds 11.4% of 882.7 million shares price practically $36 billion.

Nonetheless, because the gross sales proceed, it’s approaching Vanguard’s 639 million shares.

Though there are several theories Why Berkshire is promoting shares that Buffett says Just like last year recently, he doesn’t want to sell.Regardless of his issues in regards to the banking trade as a complete, Omaha has up to now provided no clarification.

Buffett turns 94 on Friday. As of June 30, Berkshire’s money reserves reached a file $277 billion.