Jim Bianco, CEO of Bianco Analysis, mentioned that though the latest launch of Bitcoin ETFs or exchange-traded funds in the USA appears to have prompted pleasure, these monetary merchandise haven’t but fulfilled their anticipated function as main catalysts for cryptocurrency adoption.

in a postal Bianco shared on Elon Musk’s social media platform

Bitcoin ETF outflows and lack of institutional participation

Bianco’s feedback underscore rising skepticism concerning the Bitcoin ETF’s efficiency because it first traded in January.

Regardless of the hype surrounding the potential of a spot Bitcoin ETF forward of its launch, Bianco pointed to some indicators that the market could not but be mature. As powerful as expected.

Key points cited by specialists embody latest outflows, losses for holders of those ETFs, and a common lack of main institutional funding, all of which counsel the Bitcoin ETF market may have extra time fully developed.

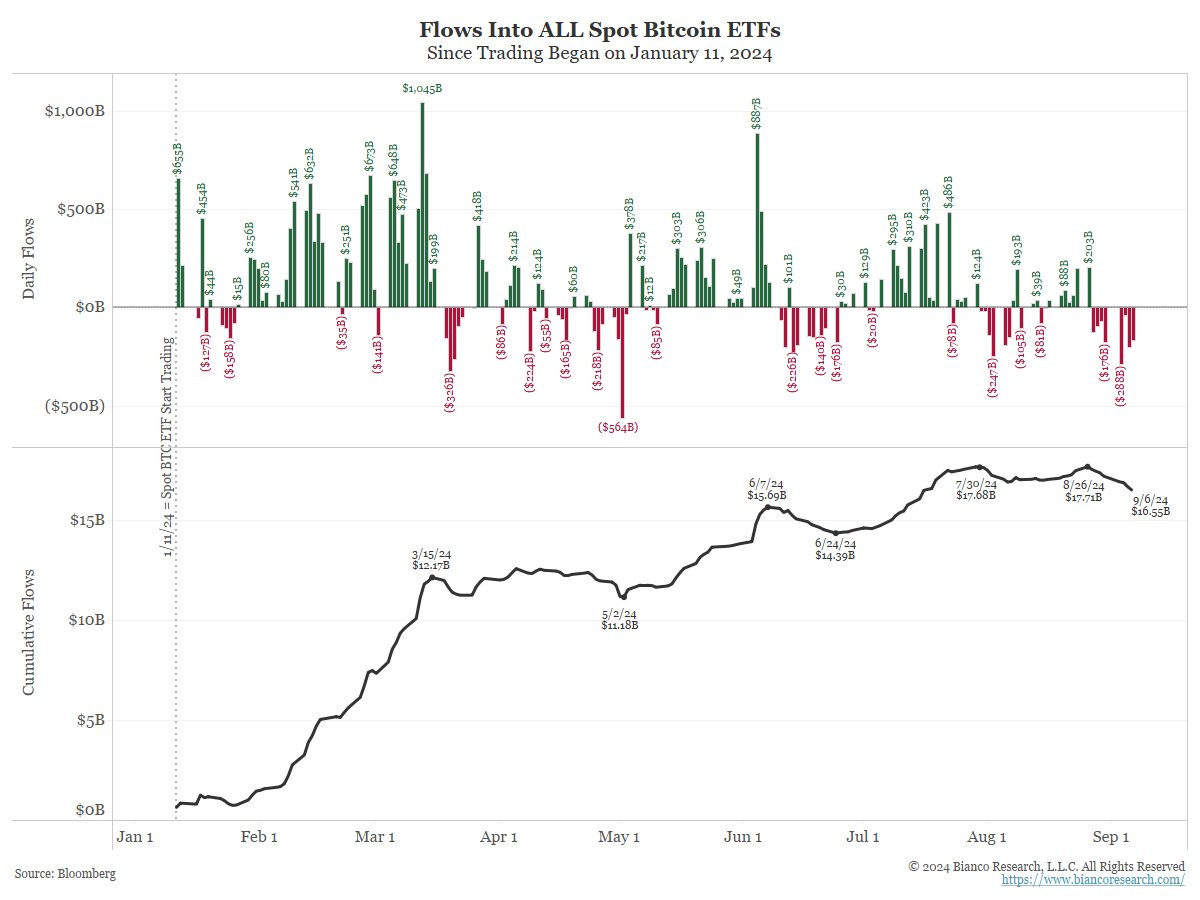

One of many key factors Bianco raised was the big web outflows inside the Bitcoin ETF market. Quoting knowledge from Farside Buyers, Bianco show Previously eight buying and selling days alone, the web outflows of 11 U.S. Bitcoin ETFs exceeded $1 billion.

This has diminished whole property underneath administration (AUM) of Bitcoin ETFs to about $48 billion from a peak of $61 billion in March. Bianco believes these outflows exhibit the necessity for extra sustained curiosity and capital inflows from institutional buyers.

He additional identified that many of the inflows into Bitcoin ETFs got here from current cryptocurrency holders who moved positions again to conventional monetary (Trad-Fi) accounts, quite than from new buyers getting into the market. This implies the ETF will not be attracting new cash as initially hoped.

Bianco provides credibility to suspicion mention Even BlackRock has confirmed that roughly 80% of Bitcoin ETF purchases could also be made by self-directed on-line accounts, additional indicating that institutional investors Not but absolutely concerned within the Bitcoin ETF market.

The skilled added:

Cryptocurrency quantitative evaluation reveals that almost all spot BTC ETF inflows are from on-chain holders transferring again to tradfi accounts, so there may be little or no “new” cash getting into the cryptocurrency area. Thus far, these instruments haven’t lived as much as the “child boomers are coming” hype. Few have come, and those that have come are holding losses and should now depart ($1 billion in outflows within the final 8 days).

What does it take for the Bitcoin ETF market to mature?

Though the latest efficiency Bitcoin The ETFs could not have lived as much as preliminary expectations, however Bianco stays optimistic that they’ll nonetheless be a helpful device for cryptocurrency adoption.

He emphasised the have to be “affected person” and develop extra on-chain instruments that may transfer the market ahead. Bianco mentioned Bitcoin could take “a number of seasons, together with a winter or two and a improvement breakout” to materialize ETF market Actually hitting the bottom operating.

The CEO famous:

Can these instruments grow to be instruments for adoption? Sure, perhaps after the following one (2028) and after the foremost improvement of on-chain instruments first occurs. (i.e. BTC chain DeFi, NFT, cost, and many others.)

Featured picture created utilizing DALL-E, chart from TradingView